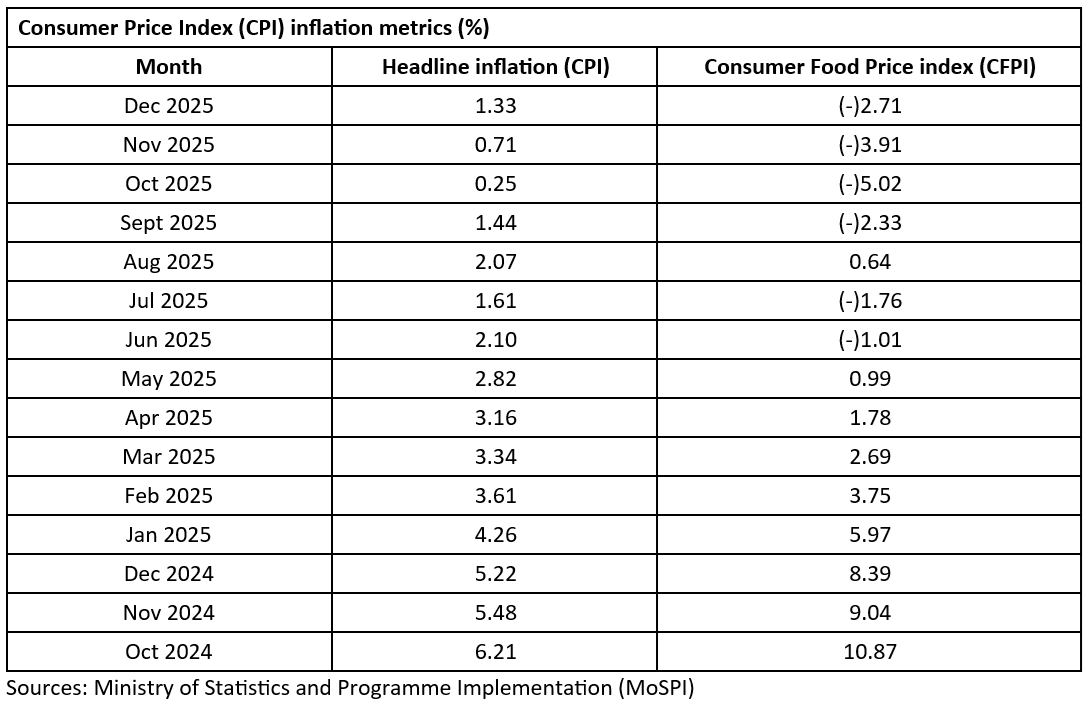

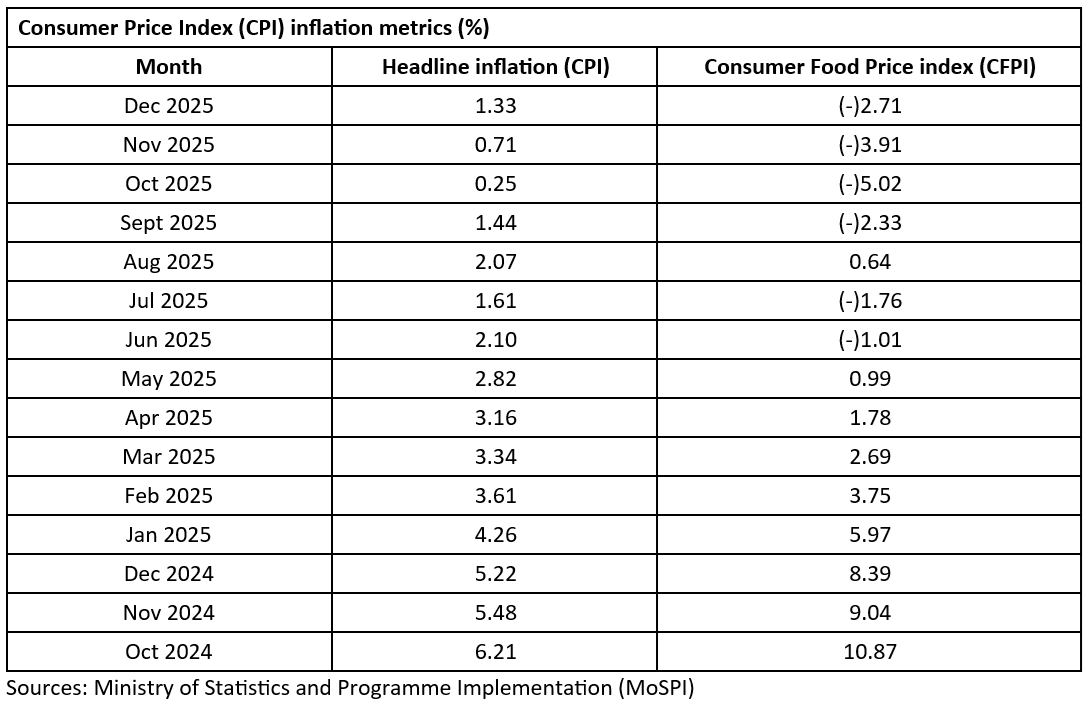

India’s retail inflation, measured by the Consumer Price Index (CPI), rose to a three-month high of 1.33 percent in December due to an unfavourable base effect, but remained below the Reserve Bank of India’s (RBI’s) comfortable lower band of 2 percent, aided by a contraction in food prices, according to a statement from the Ministry of Statistics and Programme Implementation (MoSPI). This marked an increase of 62 basis points from the 0.71 percent retail inflation recorded in November 2025, while remaining sharply lower than the 5.22 percent reported in the corresponding month of the previous year.

The MoSPI statement added, “The year-on-year (YoY) inflation rate based on the All-India Consumer Price Index (CPI) for December 2025 over December 2024 stood at 1.33 percent (provisional). Headline inflation in December 2025 increased by 62 basis points compared with November 2025. In the urban sector, headline inflation rose from 1.40 percent in November 2025 to 2.03 percent (provisional) in December 2025. Food inflation also increased from (-)3.60 percent in November 2025 to (-)2.09 percent (provisional) in December 2025.”

Commenting on the data, Madan Sabnavis, Chief Economist at Bank of Baroda, said, “Inflation for December came in at 1.3 percent, almost in line with our forecast of 1.4 percent. During the month, several factors influenced prices. While a good harvest continued to bring down food prices, the impact of GST varied across commodities depending on their classification under the new regime. The base effect played a significant role in keeping overall inflation low.”

Food inflation

Food inflationAccording to government data, the year-on-year (YoY) inflation rate based on the All-India Consumer Food Price Index (CFPI) for December 2025 over December 2024 stood at (-)2.71 percent (provisional). The corresponding inflation rates for rural and urban areas were (-)3.08 percent and (-)2.09 percent, respectively. Food inflation increased by 120 basis points in December 2025 compared with November 2025. The rise in headline inflation and food inflation during December 2025 was mainly attributed to higher inflation in personal care and effects, vegetables, meat and fish, eggs, spices, and pulses and products.

Commenting on the data, Dipti Deshpande, Principal Economist at Crisil Ltd, said, “The uptick was driven by food, where deflation narrowed as the high base effect gradually waned. Food inflation in December stood at (-)2.7 percent compared with (-)3.9 percent in November. Inflation in meat, fish and eggs increased, while vegetables, pulses and spices saw lower deflation. Notably, the protein component (pulses and products, eggs, meat and fish), which had dipped to a low of (-)5.1 percent in July, stood at (-)2.2 percent in December. Meanwhile, cereals inflation entered negative territory for the first time since September 2021, driven by falling wheat and rice prices.”

Sector-wise performanceEdible oil inflation, which peaked at 21.2 percent in August, declined sharply to 6.8 percent in December. The vegetable category narrowed its deflation from a trough of (-)27.6 percent in October to (-)18.5 percent in December. Inflation in pan, tobacco and intoxicants rose by 3 percent, with the GST impact proving significant after the rate was increased to 40 percent for several components. In contrast, GST relief for clothing and footwear helped keep inflation low at 1.4 percent.

Inflation in fuel and light and housing stood at 2 percent and 2.9 percent, respectively, as these components were less affected by the GST regime. Inflation in the miscellaneous category remained elevated at 6.2 percent, driven largely by personal care items, where inflation surged to 28 percent, with the rise in gold prices playing a key role.

Sabnavis added, “Looking ahead, inflation is expected to edge up towards 3 percent over the next three months as the base effect weakens and price indices normalise. Inflation is likely to average 2.3–2.4 percent for the year. At the state level, southern states—particularly Kerala—recorded higher inflation, mainly due to stronger gold consumption. Other states with elevated inflation included Karnataka, Andhra Pradesh, Tamil Nadu, and Jammu & Kashmir.”

External environmentOn the external front, global commodity prices have remained broadly stable, supported by oversupply in the global crude oil market and persistent overcapacity in China. The global crude oil supply glut is likely to persist into calendar year 2026, with production continuing to outpace consumption. The Organisation of the Petroleum Exporting Countries and its allies (OPEC+) production policies, along with elevated inventory levels, should help cap any significant upside in crude oil prices.

Recent tensions in Venezuela are unlikely to materially impact oil markets, given the country’s limited share of global production. Nevertheless, geopolitical risks—particularly in the Middle East—warrant close monitoring due to their potential implications for energy prices. In contrast, several base metals, such as copper and aluminium, have witnessed sharp price increases, driven by strong industrial demand from renewable energy and AI-related sectors, US Federal Reserve rate cuts, and expectations of fiscal stimulus in China.

Commenting on the outlook, Rajani Sinha, Chief Economist at Care Ratings Ltd, said, “Looking ahead, headline inflation is expected to edge higher but remain below the RBI’s 4 percent target for the rest of FY2025-26. For FY2025-26 and FY2026-27, CPI inflation is projected to average around 2.1 percent and 4 percent, respectively, based on the current CPI basket. The rollout of the new CPI series with a 2024 base year next month will be an important development to watch. From a monetary policy standpoint, the recent uptick in inflation is unlikely to trouble the RBI. While inflation projections leave room for a further 25 bps rate cut, we expect the MPC to pause and conserve policy space, opting to ease only if growth conditions deteriorate.”

DILIP KUMAR JHA

Editor

dilip.jha@polymerupdate.com

The MoSPI statement added, “The year-on-year (YoY) inflation rate based on the All-India Consumer Price Index (CPI) for December 2025 over December 2024 stood at 1.33 percent (provisional). Headline inflation in December 2025 increased by 62 basis points compared with November 2025. In the urban sector, headline inflation rose from 1.40 percent in November 2025 to 2.03 percent (provisional) in December 2025. Food inflation also increased from (-)3.60 percent in November 2025 to (-)2.09 percent (provisional) in December 2025.”

The MoSPI statement added, “The year-on-year (YoY) inflation rate based on the All-India Consumer Price Index (CPI) for December 2025 over December 2024 stood at 1.33 percent (provisional). Headline inflation in December 2025 increased by 62 basis points compared with November 2025. In the urban sector, headline inflation rose from 1.40 percent in November 2025 to 2.03 percent (provisional) in December 2025. Food inflation also increased from (-)3.60 percent in November 2025 to (-)2.09 percent (provisional) in December 2025.”