Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

This week, PP prices plunged in the European region. An industry source in Europe informed a Polymerupdate team member, "The European polypropylene market experienced additional price declines over the week, influenced by sluggish demand and reduced feedstock costs. Concurrently, spot prices plummeted to their lowest point since January 2024, as a surge in import offers led to lower offers from sellers. This situation, coupled with a Euro 65/mt reduction in the May monthly contract price (MCP) for feedstock propylene, has applied downward pressure on PP spot prices. The significant declines may indicate some concern among sellers amid persistently low demand, potentially motivating them to mitigate the risks associated with excess supply on their balance sheets.”

An industry source in Europe informed a Polymerupdate team member, "The European polypropylene market experienced additional price declines over the week, influenced by sluggish demand and reduced feedstock costs. Concurrently, spot prices plummeted to their lowest point since January 2024, as a surge in import offers led to lower offers from sellers. This situation, coupled with a Euro 65/mt reduction in the May monthly contract price (MCP) for feedstock propylene, has applied downward pressure on PP spot prices. The significant declines may indicate some concern among sellers amid persistently low demand, potentially motivating them to mitigate the risks associated with excess supply on their balance sheets.”

Demand for spot material remained weak, primarily due to ongoing low demand from key automotive and construction sectors. Although packaging demand held steady, it was not enough to counterbalance the rising supply in the market. Market participants indicated that an increase in demand is unlikely under the current economic conditions. Additionally, uncertainty regarding the implications of US-China tariffs and trade negotiations has led buyers to postpone material purchases.

On the supply front, the availability of PP remained robust, exacerbated by subdued activity in the spot market. Competitive offers for materials from the Middle East and Asia further enhanced PP availability. However, logistical challenges are causing delays for both local suppliers and importers. While such conditions might have supported pricing in different circumstances, the current fundamentals, particularly weak demand, are preventing any stabilization of prices.

The decline in spot prices occurred despite several plant shutdowns. Normal supply has yet to be restored from polypropylene plants in Spain and Portugal that ceased operations following a sudden power outage on April 28. Although some of these facilities are slowly coming back online, their operational status remains uncertain. Additionally, a cracker in northern France is still offline and has declared force majeure regarding the supply of feedstock propylene. However, the nearby polypropylene plant has resumed production by sourcing propylene through imports. Furthermore, a polypropylene plant in the Netherlands is set to begin a scheduled turnaround in the last week of May, which is expected to last until the end of June.

Market participants noted minimal differences in the performance of copolymer and homopolymer injection-grade materials, although the price gap between the two grades widened due to residual localized demand for copolymer.

Contract pricing has also experienced downward pressure due to the reduction in the May propylene monthly contract price. The market aims to transfer the complete decline in the monomer price to polypropylene producers, who are attempting to maintain their pricing position; however, the healthy supply complicates their efforts. The realization of such pricing targets remains uncertain, particularly if weak demand persists in the upcoming weeks. Conversely, buyers are focused on ensuring that the full decrease in monomer prices is reflected in their polypropylene contracts. Some buyers anticipate that polypropylene contract prices may face additional pressure later in May, especially if there is an oversupply in the market."

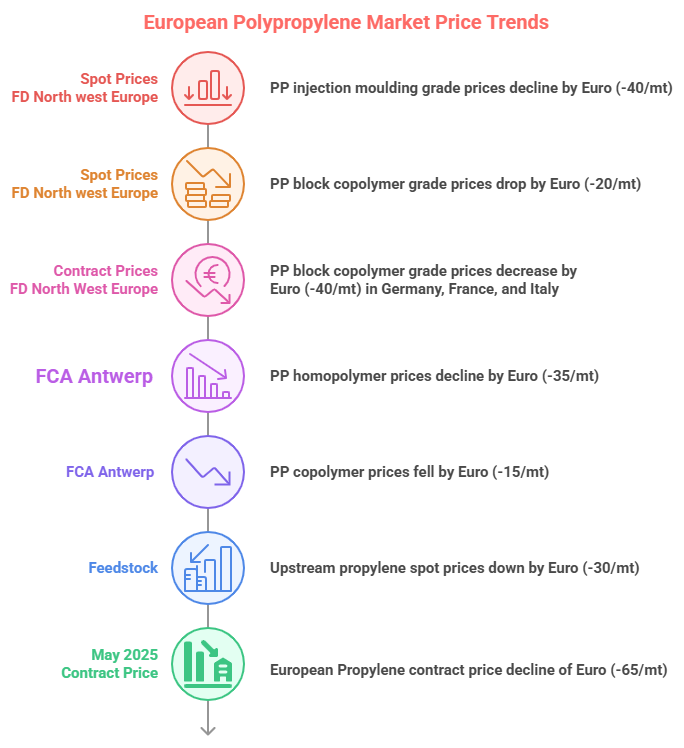

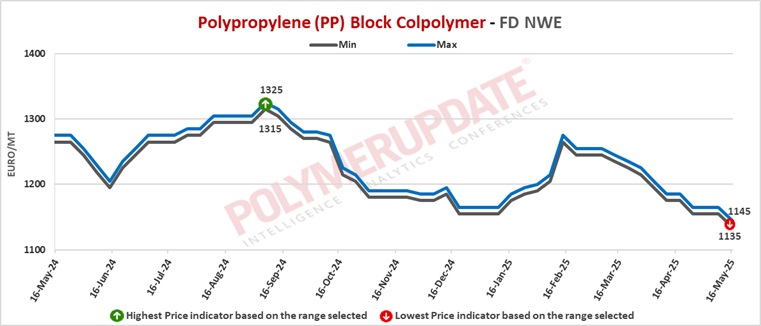

In the spot markets, PP injection moulding grade prices were assessed at the Euro 1035-1045/mt FD North West Europe mark, sharply declined by Euro (-40/mt) from the previous week, while PP block copolymer grade prices were assessed at the Euro 1135-1145/mt FD Northwest Europe levels, a week on week drop of Euro (-20/mt).

Meanwhile in the contract markets, PP injection moulding grade prices were assessed at the Euro 1425-1430/mt FD NWE Germany and FD NWE France levels, both dropped sharply by Euro (-40/mt) week on week. PP injection moulding grade prices were assessed at the Euro 1415-1420/mt FD NWE Italy levels, a steep fall of Euro (-40/mt) from the previous week. Meanwhile, PP injection moulding grade prices were assessed at the GBP 1200-1205/mt FD NWE UK levels, a tumble of GBP (-45/mt) from last week.

In the contract markets, PP block copolymer grade prices were assessed at the Euro 1495-1500/mt FD NWE Germany and FD NWE France levels, both steeply lower by Euro (-40/mt) week on week. PP block copolymer grade prices were assessed at the Euro 1485-1490/mt FD NWE Italy levels, a sharp decline of Euro (-40/mt) from the previous week. Meanwhile, PP block copolymer grade prices were assessed at the GBP 1260-1265/mt FD NWE UK levels, constant from last week. The source added, "Despite the decline in spot prices increasing the disparity with contract prices, producers are of the opinion that it is essential for polypropylene (PP) contract margins to remain stable. They highlight the challenges posed by low margins and a demand landscape that jeopardizes the financial viability of their operations in Europe, which are already at a competitive disadvantage compared to other regions. This situation is underscored by a series of asset evaluations and recent announcements of permanent closures. The most recent development occurred, with a producer reporting a halt in the refurbishment of its Wilton cracker in the UK, attributing the decision to economic uncertainty and difficult market conditions”.

The source added, "Despite the decline in spot prices increasing the disparity with contract prices, producers are of the opinion that it is essential for polypropylene (PP) contract margins to remain stable. They highlight the challenges posed by low margins and a demand landscape that jeopardizes the financial viability of their operations in Europe, which are already at a competitive disadvantage compared to other regions. This situation is underscored by a series of asset evaluations and recent announcements of permanent closures. The most recent development occurred, with a producer reporting a halt in the refurbishment of its Wilton cracker in the UK, attributing the decision to economic uncertainty and difficult market conditions”.

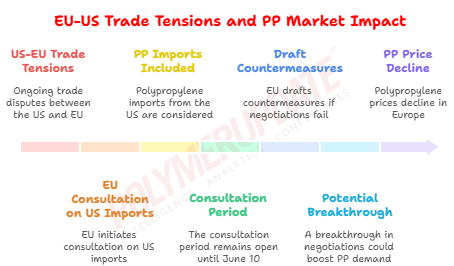

Concurrently, trade tensions between the US and EU present an additional layer of uncertainty for market stakeholders. On May 8, the European Commission initiated a public consultation regarding a list of US imports, alongside those already designated for tariff implementation, which may face EU countermeasures if the ongoing negotiations do not yield a favourable resolution and the US tariffs are not lifted. Polypropylene imports from the US were included in this consultation list. The EU does not rely heavily on US-sourced PP imports, as the price differentials often render this trade unviable. The consultation period will remain open until June 10, after which a final proposal for countermeasures will be drafted, along with a legal framework for their enforcement should negotiations with the US fail to achieve satisfactory outcomes. This development can be interpreted in various ways; however, it may be contended that the announcement itself does not indicate any significant progress between the two parties thus far. Nevertheless, should negotiations lead to a breakthrough, particularly concerning automotive exports, it could enhance PP demand in Europe from that sector, which has been adversely affected by low demand and challenging market conditions.

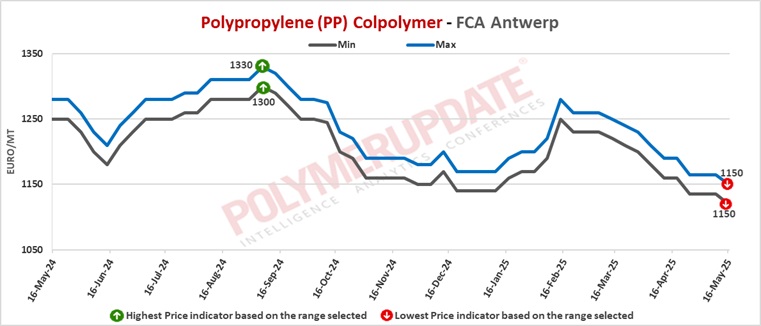

FCA Antwerp PP homopolymer prices were assessed at the Euro 1020-1050/mt level, a decline of Euro (-35/mt) from last week, while FCA Antwerp PP copolymer prices were assessed at the Euro 1120-1150/mt levels, a drop of Euro (-15/mt) week on week.

Upstream propylene spot prices on Thursday were assessed at the Euro 815-825/mt FD Northwest Europe levels, lower by Euro (-30/mt) from last week.

European Propylene contract price for May 2025 settled at the Euro 1015/MT FD North West Europe levels. This price represents a sharp decline of Euro 65/mt from its April 2025 settlement levels.