Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

This week, HDPE spot prices slipped while contract prices remained flat in the European region.

An industry source in Europe informed a Polymerupdate team member, "European High Density Polyethylene (HDPE) prices are experiencing downward pressure due to competitive imports and uncertain demand. Recently, spot prices for various grades of European HDPE have started to decrease, influenced by the influx of competitively priced imports. Supplies from the United States and Canada continue to enter the European market at aggressive price levels, heightening competition with domestic products. These import offers have gained momentum despite a slowdown in regional activity attributed to the Easter holidays.”

There is considerable pressure from incoming US materials, as stakeholders are keen to reduce existing inventories in anticipation of the next wave of imports.

A wide range of spot prices has been observed across different polyethylene grades; however, Low density polyethylene (LDPE) seems to be the least impacted, as import volumes for this grade remain limited compared to Linear low density polyethylene (LLDPE) and High density polyethylene (HDPE). Market participants have indicated that supply is plentiful across most segments, although perspectives on demand trends are varied.

Some domestic manufacturers and converters expressed more positive perspectives, highlighting stable or slightly increased order volumes in April compared to March. In contrast, numerous distributors and end-users characterized the demand fundamentals as weak, pointing to limited trading activity for most of April due to ongoing market uncertainty regarding tariffs and persistent softness in downstream demand.

Weaker demand conditions prompted some participants to take extended holiday breaks, opting to wait out the sluggish business climate. Attention has now turned to May, with many market players closely monitoring the forthcoming settlement of the monthly ethylene monomer contract price (MCP). A reduction in the May MCP is widely expected, primarily due to the decline in average naphtha prices noted throughout April.

In the contract market, April settlements were generally reported as rollovers from March, despite decreasing feedstock costs and initial attempts by producers to advocate for price increases.

Looking forward, market sentiment remains predominantly uncertain as the industry grapples with tariff-related concerns and a potential oversupply from imports. While domestic producers have shown cautious optimism for improvements in May, traders continue to express apprehension about a possible surge in imported volumes disrupting the delicate equilibrium between supply and demand.

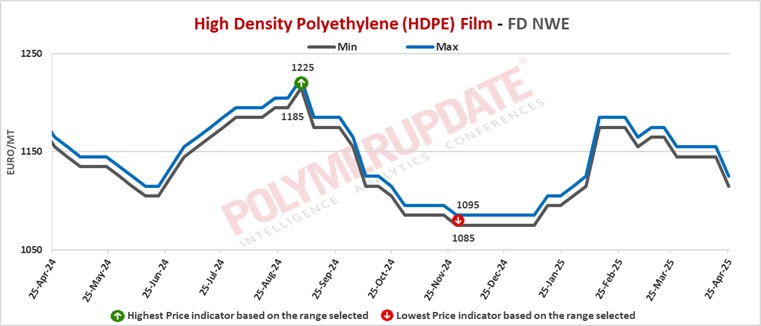

In the spot markets, HDPE film grade prices were assessed at the Euro 1115-1125/mt FD North West Europe levels, while HDPE BM grade prices were assessed at the Euro 1115-1125/mt FD North West Europe levels, both falling by Euro (-30/mt) from the previous week. Meanwhile, HDPE injection grade prices were assessed at the Euro 1095-1105/mt FD North West Europe levels, a decline of Euro (-30/mt) from last week.

In the contract markets, HDPE film grade prices were assessed at the Euro 1640-1645/mt FD NWE Germany and FD NWE Italy levels, both steady week on week. HDPE film grade prices were assessed at the Euro 1640-1645/mt FD NWE France levels, flat from last week. Meanwhile, HDPE film grade prices were assessed at the GBP 1405-1410/mt FD NWE UK levels, unchanged from the previous week.

In the contract markets, HDPE BM grade prices were assessed at the Euro 1620-1625/mt FD NWE Germany and FD NWE Italy levels, both left unchanged week on week. HDPE BM grade prices were assessed at the Euro 1620-1625/mt FD NWE France levels, flat from the previous week. Meanwhile, HDPE BM grade prices were assessed at the GBP 1390-1395/mt FD NWE UK levels, stable from last week.

In the contract markets, HDPE injection grade prices were assessed at the Euro 1580-1585/mt FD NWE Germany and FD NWE Italy levels, both steady week on week. HDPE injection grade prices were assessed at the Euro 1580-1585/mt FD NWE France levels, rolled over from the previous week. Meanwhile, HDPE injection grade prices were assessed at the GBP 1355-1360/mt FD NWE UK levels, left unchanged from last week.

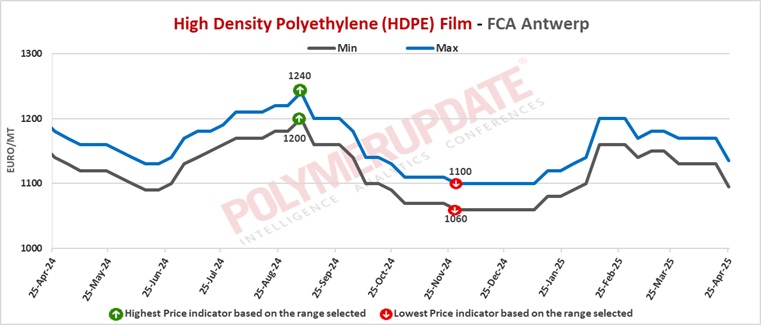

FC Antwerp HDPE film prices were assessed at the Euro 1095-1135/mt levels while FCA Antwerp HDPE BM prices were assessed at the Euro 1095-1125/mt levels, both dropped by Euro (-35/mt) from the previous week. Meanwhile, HDPE injection prices were assessed at the Euro 1075-1105/mt levels, a decline of Euro (-35/mt) from week on week.

Ethylene spot prices on Thursday were assessed at the Euro 785-795/mt FD North West Europe levels, a fall of Euro (-15/mt) week on week.

European ethylene contract price for April 2025 settled at the Euro 1205/MT FD North West Europe levels. This price represents a plunge of Euro 55/MT from its March 2025 settlement levels.