Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

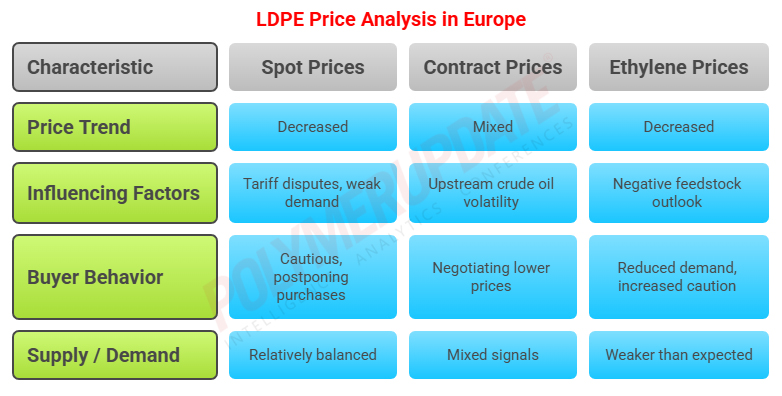

This week, LDPE spot prices down adjusted in the European region.

An industry source in Europe informed a Polymerupdate team member, "The European LDPE markets experienced stable to slight declines in spot prices this week, influenced by uncertainties surrounding tariff disputes and ongoing weakness in demand for derivatives. Spot prices decreased as market tightness eased and overall sentiment weakened. While low-density polyethylene  (LDPE) is less dependent on imports, the softening sentiment in other grades may have an impact on LDPE as well.”

(LDPE) is less dependent on imports, the softening sentiment in other grades may have an impact on LDPE as well.”

Activity in the European polyethylene (PE) market remained low this week, amid rising global political uncertainties. This situation contributed to significant volatility in upstream crude oil and naphtha prices, leading many market participants to adopt a cautious approach.

Numerous buyers chose to remain inactive, observing market trends before finalizing their monthly agreements. Some sellers reported that buyers were able to negotiate lower prices than those previously offered. Additionally, the supply of LDPE was noted to be relatively balanced over the past week, despite reduced operating rates from domestic producers. Demand fundamentals showed mixed signals, as traders and distributors reported a lack of enthusiasm for the material, while domestic producers indicated strong order volumes for the month.

The source added, "The European Union had proposed implementing reciprocal tariffs on imports from the United States, with a tentative start date of April 13, pending approval. This proposal specifically targeted polyethylene (PE) imports from the US, with preliminary estimates indicating potential tariffs around 25%. Meanwhile a decision by the EU to put counter-tariffs on hold has mitigated the immediate pricing impact on US-sourced PE shipments that are already on their way to Europe. The complete effects on supply and pricing are anticipated to be more evident by May. In the meantime, the Easter holiday shutdowns at various converter plants across Europe may reduce short-term demand, providing a temporary buffer against market disruptions throughout April.”

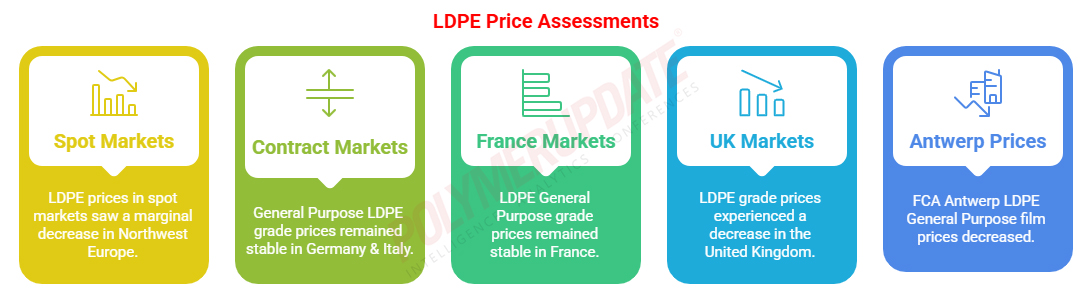

In the spot markets, LDPE prices were assessed at the Euro 1255-1265/mt FD Northwest Europe mark, a marginal week on week fall of Euro (-5/mt).

In the contract markets, General Purpose LDPE grade prices were assessed at the Euro 1980-1985/mt FD NWE Germany and FD NWE Italy levels, both unchanged from the previous week. LDPE General Purpose grade prices were assessed at the Euro 1980-1985/mt FD NWE France levels, stable from last week. Meanwhile, LDPE grade prices were assessed at the GBP 1700-1705/mt FD NWE UK levels, a week on week drop of GBP (-10/mt).

FCA Antwerp LDPE General Purpose film prices were assessed at the Euro 1235-1255/mt levels, down Euro (-5/mt) from the previous week.

Crude oil prices have experienced significant fluctuations this week. On April 1, the monthly contract price (MCP) for feedstock ethylene decreased by Euro 55/mt as compared to March's MCP. However, recent trends in upstream oil prices suggest that ethylene's MCP for May could face another substantial decline.

The negative outlook for feedstock has led to a reduction in demand and increased caution among buyers, who anticipate further decreases in polyethylene (PE) prices. Many are postponing their purchases until May where feasible, opting to make as-required purchases. The ability of buyers to do this largely depends on their existing stock levels, particularly since some had already reduced their procurement in early March due to a similar pricing forecast. While some buyers refrained from restocking in late March, others chose to secure some of their volume needs early in April to mitigate potential supply risks. Market participants have also noted weaker-than-expected demand across various value chains, which has diminished converters' urgency to replenish their inventories, especially with the upcoming Easter holiday closures affecting many plants.

Additionally, contract negotiations are expected to shift focus, as discussions around tariffs have been temporarily sidelined. Current negotiations range from maintaining prices to implementing double-digit increases, despite the decline in monomer prices for April. This situation provides producers with leverage to uphold strong pricing strategies established in March. Many European producers have reportedly revised their initial price increase targets downward after reassessing market fundamentals and the volatility caused by tariff issues. Other producers are positioned between maintaining current prices and implementing increases from March levels.

Ethylene spot prices on Thursday were assessed at the Euro 800-810/mt FD North West Europe levels, a drop of Euro (-20/mt) week on week.

European ethylene contract price for April 2025 settled at the Euro 1205/MT FD North West Europe levels. This price represents a plunge of Euro 55/MT from its March 2025 settlement levels.