Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

This week, PP prices drifted lower in the European region.

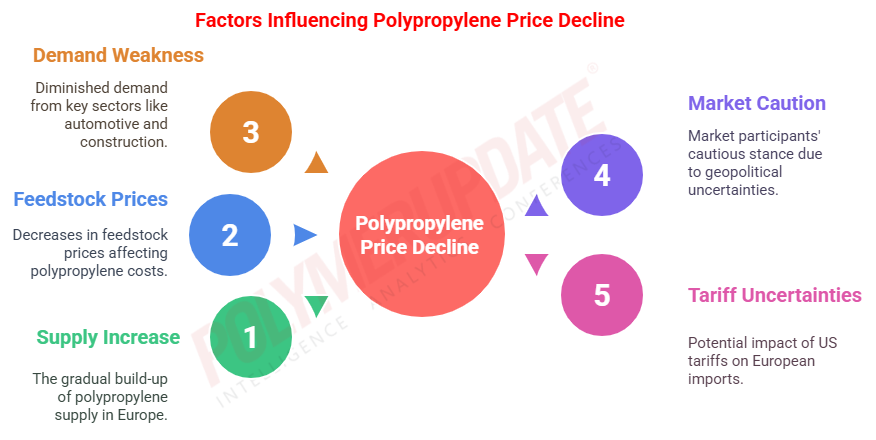

An industry source in Europe informed a Polymerupdate team member, "European polypropylene markets experienced an increase in supply and a decline in prices during the week, influenced by falling feedstock costs and diminishing demand, which have collectively exerted a downward pressure on pricing trends. The decrease in feedstock prices for polypropylene prompted consumers to seek lower spot and contract prices compared to March. This week, the polypropylene market exhibited caution amid uncertainties surrounding global geopolitical developments. Additionally, the European PP market witnessed a gradual increase in supply during March, coinciding with a reduction in demand, as buyers adopted a more reserved approach due to the bearish trends in upstream oil and naphtha prices."

Meanwhile, despite a disruption at the Tarragona polypropylene unit on April 1, the availability of polypropylene remained robust due to weak demand from critical sectors. While demand from the packaging sector for polypropylene remained steady, supply continued to be in surplus quantities due to ongoing low demand from the automotive and construction industries. The ample availability of material has been further bolstered by competitive offers from Asia and the influx of imported materials from South Korea into the European market.

The source added, “Beyond the fundamentals of demand and supply, market participants were closely monitoring the potential impact of US tariffs on the European market. The announcement made by US President Donald Trump on April 2 to impose tariffs on all imports into the US—including a 20% tariff on EU imports, in addition to existing tariffs—created significant disruption and caused polypropylene (PP) market participants to adopt a cautious stance as they evaluated the ramifications of this news. This announcement triggered a widespread market sell-off and a notable decline in oil prices.” In response, the EU had proposed reciprocal tariffs on US imports, which, if approved, were set to take effect on April 13. However, the move to impose reciprocal tariffs has been suspended by the EU following a 90-day pause on the imposition of highest tariffs by US President Donald Trump. However, in spite of currently prevailing tariff uncertainties, the supply of PP is not expected to be directly impacted, as it is not included in the EU's list of products targeted for retaliatory tariffs, with the US holding a negligible share of the PP market in Europe. Nevertheless, an escalation in the trade conflict between the trade partners could have indirect effects on PP demand, which is already experiencing weak conditions. This impact will be particularly pronounced in the automotive sector, especially since the US has enacted a blanket tariff of 25% on all automotive imports. Over 10% of Germany's automotive production is exported to the US, and this situation is likely to affect PP demand from that sector.

In response, the EU had proposed reciprocal tariffs on US imports, which, if approved, were set to take effect on April 13. However, the move to impose reciprocal tariffs has been suspended by the EU following a 90-day pause on the imposition of highest tariffs by US President Donald Trump. However, in spite of currently prevailing tariff uncertainties, the supply of PP is not expected to be directly impacted, as it is not included in the EU's list of products targeted for retaliatory tariffs, with the US holding a negligible share of the PP market in Europe. Nevertheless, an escalation in the trade conflict between the trade partners could have indirect effects on PP demand, which is already experiencing weak conditions. This impact will be particularly pronounced in the automotive sector, especially since the US has enacted a blanket tariff of 25% on all automotive imports. Over 10% of Germany's automotive production is exported to the US, and this situation is likely to affect PP demand from that sector.

In this context, the pricing trend for polypropylene (PP) appears to be bearish in April, although there remains some uncertainty regarding the extent of potential price reductions. A few market participants have opined that freely negotiated PP contract prices may experience more significant declines than the Euro 55/ton decrease observed in the April market clearing price (MCP) for feedstock propylene. This situation may be influenced by sellers who are under pressure to sell their volumes. Additionally, the Easter holiday shutdowns at numerous converters' facilities could further dampen immediate demand in April.

The demand across various European value chains is anticipated to remain difficult, particularly with the automotive sector likely to face intensified challenges. Conversely, demand from the flexible packaging sector has shown more resilience, primarily due to its connection with fast-moving consumer goods. However, other sectors are struggling, as high energy costs in Europe exacerbate their competitive disadvantages compared to other regions. Some converters may consider relocating a portion of their production capacity abroad, while many buyers are expected to remain cautious regarding their volume purchases.

The implementation of high tariffs on imports from several Southeast Asian nations into the United States may further complicate the future supply forecast for European polypropylene (PP) pricing. Asian markets are currently grappling with an oversupply in PP production, and many of the impacted countries are significant exporters of consumer goods to the US, primarily consisting of low-value, high-volume items. A decline in demand for these finished products could lead to a PP supply glut in Asian markets, potentially leading to increased PP shipments to Europe from the Middle East and Asia-Pacific regions. Additionally, a rise in the euro's exchange rate against the US dollar will enhance import economics by reducing costs for European purchasers, thereby providing them with greater negotiating power in discussions with European suppliers.

In the meantime, naphtha prices have experienced a significant decline on a week-to-week basis, reflecting the downward trend in crude oil prices. Although it is premature to draw definitive conclusions, this trend may indicate a potential further reduction in the feedstock propylene's May monthly contract price (MCP) if the lower naphtha prices persist in the upcoming weeks. This situation could maintain a bearish trend in PP pricing beyond April, while also granting integrated producers some flexibility in PP pricing during April, as their profit margins improve due to reduced feedstock costs.

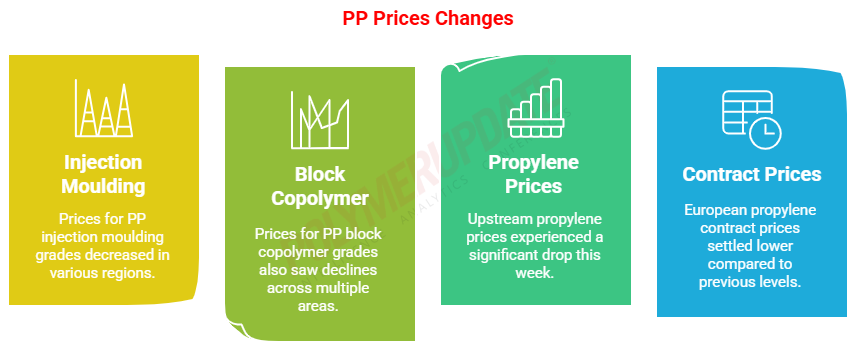

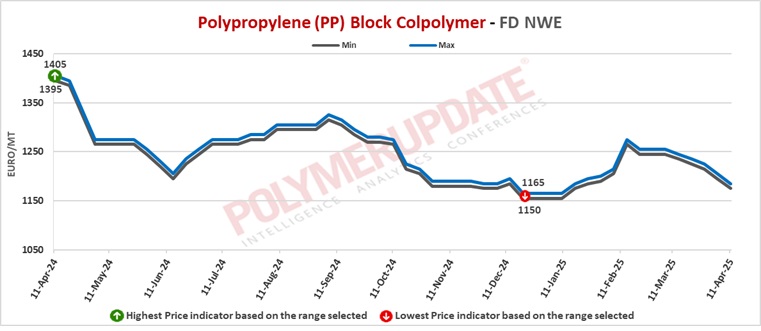

In the spot markets, PP injection moulding grade prices were assessed at the Euro 1115-1125/mt FD North West Europe mark, a week on week fall of Euro (-20/mt). Meanwhile, PP block copolymer grade prices were assessed at the Euro 1175-1185/mt FD Northwest Europe levels, down Euro (-20/mt) from the previous week.

Meanwhile in the contract markets, PP injection moulding grade prices were assessed at the Euro 1520-1525/mt FD NWE Germany and FD NWE France levels, both dropped by Euro (-20/mt) from the previous week. PP injection moulding grade prices were assessed at the Euro 1510-1515/mt FD NWE Italy levels, a week on week fall of Euro (-20/mt). Meanwhile, PP injection moulding grade prices were assessed at the GBP 1315-1320/mt FD NWE UK levels, an increase of GBP (+25/mt) from last week.

In the contract markets, PP block copolymer grade prices were assessed at the Euro 1590-1595/mt FD NWE Germany and FD NWE France levels, both week on week declined by Euro (-20/mt). PP block copolymer grade prices were assessed at the Euro 1580-1585/mt FD NWE Italy levels, a decrease of Euro (-20/mt) from last week. Meanwhile, PP block copolymer grade prices were assessed at the GBP 1375-1380/mt FD NWE UK levels, a sharp rise of GBP (+30/mt) from the previous week.

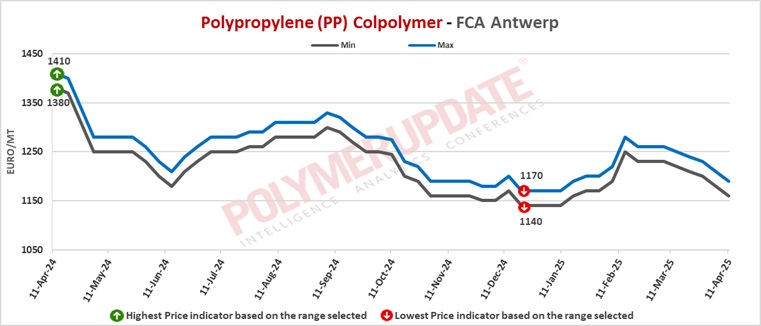

FCA Antwerp PP homopolymer prices were assessed at the Euro 1100-1130/mt level, while FCA Antwerp PP copolymer prices were assessed at the Euro 1160-1190/mt levels, both decreasing by Euro (-20/mt) week on week.

Upstream propylene spot prices on Thursday were assessed at the Euro 910-920/mt FD Northwest Europe levels, sharply lower by Euro (-35/mt) from last week.

European propylene contract price for April 2025 settled at the Euro 1080/MT FD North West Europe levels. This price represents a sharp fall of Euro 55/mt from its March 2025 settlement levels.