Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

This week, Polystyrene prices down adjusted in the Asian region.

An industry source in Asia on condition of anonymity informed a Polymerupdate team member, "International oil prices experienced a day-on-day increase with market feedback fuelling speculation that the United States could intensify sanctions against Iran. However, Ukraine’s acceptance of a ceasefire proposal with Russia has the potential to cap the price rise." The source added, “Polystyrene prices in Asia have faced downward pressure as a result of declines in the feedstock styrene monomer prices. The demand for polystyrene is primarily driven by immediate requirements, leading some buyers to take a cautious wait-and-see approach, especially if they do not have pressing needs. This prudent strategy is shaped by a less optimistic outlook for the styrene monomer market, causing buyers to delay inventory replenishment in hopes of more favourable pricing conditions. Despite the decrease in costs, production margins for suppliers in the regional polystyrene market remained largely unaffected. As a result, many suppliers were inclined to offer slight price reductions for spot cargoes. Given the weak spot demand in China and Southeast Asia, several polystyrene manufacturers have shifted their focus to selling in more distant markets, such as Africa and Europe.”

The source added, “Polystyrene prices in Asia have faced downward pressure as a result of declines in the feedstock styrene monomer prices. The demand for polystyrene is primarily driven by immediate requirements, leading some buyers to take a cautious wait-and-see approach, especially if they do not have pressing needs. This prudent strategy is shaped by a less optimistic outlook for the styrene monomer market, causing buyers to delay inventory replenishment in hopes of more favourable pricing conditions. Despite the decrease in costs, production margins for suppliers in the regional polystyrene market remained largely unaffected. As a result, many suppliers were inclined to offer slight price reductions for spot cargoes. Given the weak spot demand in China and Southeast Asia, several polystyrene manufacturers have shifted their focus to selling in more distant markets, such as Africa and Europe.”

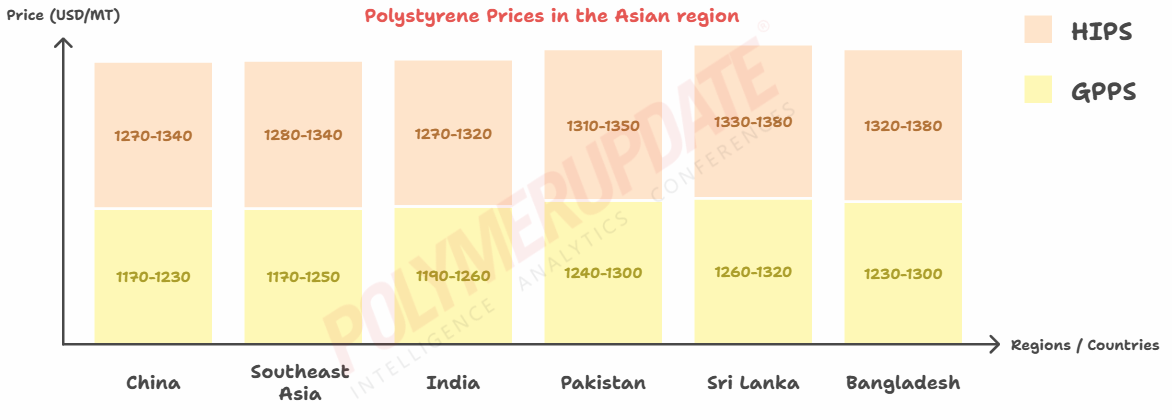

In China, GPPS prices were assessed at the USD 1170-1230/mt CFR levels, while HIPS prices were assessed at the USD 1270-1340/mt CFR levels, both week on week lower by USD (-20/mt).

In China, the market exhibited a predominantly subdued atmosphere, with the majority of Chinese polystyrene (PS) purchasers focusing on domestic negotiations. Buyers with particular PS specifications opted to hold off on purchases after noting a correction in the styrene monomer (SM) market. Some participants in the market foresee a modest uptick in import demand once the SM market reaches a state of stability.

The PS market has been primarily influenced by the downturn in styrene prices and subsequent price reductions within the market. On the cost front, styrene prices have decreased significantly due to a sharp week-on-week decline in crude oil prices and rising inventories. Regarding supply and demand dynamics, the overall production output within the industry has risen considerably, attributed to the resumption of operations by some production facilities in Jiangsu and Shandong, as well as an increase in plant utilization during this cycle.

In Southeast Asia, GPPS prices were assessed at the USD 1170-1250/mt CFR levels, a fall of USD (-10/-20/mt) from the previous week. HIPS prices were assessed at the USD 1280-1340/mt CFR levels, down USD (-10/mt) week on week.

In Southeast Asia, key stakeholders concentrated on the fluctuations in the feedstock styrene monomer (SM) market and volatile production costs. The easing of the SM market, coupled with reduced production expenses for polystyrene (PS) manufacturers, has strengthened the negotiating power of buyers. While end consumption has remained stable, it has been relatively sluggish, prompting many buyers—particularly those without immediate spot requirements—to adopt a cautious approach, observing whether shifts in the SM market might lead to further price adjustments in the PS sector.

Market participants report that certain buyers are considering the accumulation of limited polystyrene inventories at more favorable rates due to the changes in production costs. Nevertheless, regional PS purchasing is still hampered by apprehensions regarding the global macroeconomic situation and escalating trade tensions. This uncertainty is notably impacting demand for PS in industries such as packaging, electronics, and consumer goods, as downstream users exhibit a lack of confidence in consumer behavior and are reluctant to amass substantial quantities of PS. For suppliers, the evolving production cost landscape has had a minimal effect on PS production margins. Given the limited spot demand and the enhanced bargaining position of buyers with specific needs, suppliers have found it challenging to uphold high PS pricing amidst declining production costs. Most regional suppliers have shown a willingness to adjust prices to encourage some purchasing interest, as production margins have remained stable throughout the week. Changes in the SM market will continue to be a critical consideration for regional PS stakeholders when determining prices for spot cargoes in the near future.

In India, GPPS prices were assessed at the USD 1190-1260/mt CFR levels, a drop of USD (-10-/-20/mt) from last week. HIPS prices were assessed at the USD 1270-1320/mt CFR levels, lower by USD (-20/mt) from the previous week.

A domestic industry source informed a Polymerupdate team member, “Supreme Petrochem has reduced PS grade prices by Rs.1.50/kg basic, except SH 450 grade prices which have been reduced Re.0.50/kg basic, with effect from March 10, 2025. Now, GPPS 203EL grade price is Rs.117/kg basic and HIPS SH03 grade price is Rs.128.50/kg basic, Ex-Nagothane.”

Ahead of the approaching fiscal year-end, conversations surrounding cargo imports for March are slowing down, with attention shifting towards shipments scheduled for April. The competitive pricing of Chinese polystyrene (PS) is influencing the demand for materials from other Asian suppliers, while the primary focus remains on depleting current inventories. Nevertheless, an increase in demand for products designated for April lifting is expected in India.

In the Indian domestic market, the polystyrene (PS) sector is exhibiting stability, albeit at a slow pace, with prices consistently remaining within a defined range. Manufacturers are considering suspending their purchasing activities due to the steady nature of domestic prices, and negotiations regarding granule prices are currently underway.

The recent decrease in PS prices by leading manufacturers is encountering obstacles due to a reduction in labor availability linked to an upcoming festival, which is causing delays in the conversion of PS. Despite these challenges, the availability of materials remains adequate, and PS granule prices are stable. Some granule manufacturers anticipate negotiations with buyers in light of the declining PS prices.

Manufacturers who have offloaded older inventories are not facing significant selling pressure and have temporarily ceased purchasing in response to the falling prices. Market participants are adopting a cautious "wait and see" approach. Furthermore, the decline in oil prices has led to a reduction in feedstock styrene prices, which is contributing to fluctuations in domestic PS grade prices.

In Pakistan, GPPS prices were assessed at the USD 1240-1300/mt CFR levels while HIPS prices were assessed at the USD 1310-1350/mt CFR levels, both down adjusted by USD (-10/mt) from the previous week.

In Pakistan, prices have been assessed lower on the back of limited discussions in the market amid minimal offers and trade this week.

In Sri Lanka, GPPS prices were assessed at the USD 1260-1320/mt CFR levels, while HIPS prices were assessed at the USD 1330-1380/mt CFR levels, both week on week declined by USD (-20/mt).

In Sri Lanka, prices declined on the back of weak demand sentiments and lower offers in the region.

In Bangladesh, GPPS prices were assessed at the USD 1230-1300/mt CFR levels, a fall of USD (-10/mt) from the previous week. HIPS prices were assessed at the USD 1320-1380/mt CFR levels, lower by USD (-20/mt) week on week.

In Bangladesh, there has been a reduction in prices attributed to lower import offers, which are influenced by declining SM values and decreasing freight costs. Nevertheless, a disparity between buying and selling persists, as importers are reluctant to proceed with purchases amid the ongoing downward market trend.

This buy-sell disparity is anticipated to continue throughout Ramadan, with anticipation of heightened demand following Eid ul-Fitr in early April. However, importers are cautious about initiating negotiations until there is a stabilization in SM values. Furthermore, Chinese PS shipments remain competitive due to reduced feedstock and operational expenses, which is expected to impact demand and the acceptance prices for Asian materials in the near future.

In EPS market, FOB North East Asia EPS general grade prices were assessed at the USD 1210-1230/mt levels while EPS fire-retardant grade prices were assessed at the USD 1280-1300/mt levels, both declined by USD (-10/mt) from the previous week.

Domestic EPS prices have seen a considerable decrease this week, influenced by multiple factors including a significant week-on-week decline in crude oil prices, a persistent drop in styrene values, and inadequate cost support. The supply of EPS has increased, while the recovery in downstream demand has been underwhelming, further intensifying the supply-demand imbalance within the sector. A prevailing cautious sentiment has resulted in a lack of new orders, prompting some production facilities to reduce output in response to inventory pressures. Nevertheless, this output reduction has proven insufficient to offset the heightened supply resulting from the restart of certain equipment and elevated production levels, thereby creating notable inventory pressures within the industry.

Feedstock styrene monomer prices on Tuesday were assessed at the USD 985-995/mt FOB Korea levels, lower by USD (-15/mt) week on week. CFR China styrene monomer prices were assessed at the USD 990-1000/mt levels, a fall of USD (-20/mt) from last week.

In plant news, Taiwan Styrene Monomer Co (TSMC) has brought on stream its No.1 Styrene monomer (SM) unit on March 10, 2025 following a turnaround. The unit was shut for maintenance in mid-February 2025. Located in Lin Yuan, Taiwan, the No.1 SM unit has a production capacity of 180,000 mt/year.

In other plant news, Keyuan Petrochemicals has shut down its No.2 Styrene monomer (SM) plant over last weekend for maintenance. Further details on the duration of the shutdown could not be ascertained.” Located in Lin Ningbo, Zhejiang in China, the No.2 plant has a production capacity of 150,000 mt/year.