Click the icon to add a specified price to your Dashboard list. This makes it easy to keep track on the prices that matter most to you.

This week, LLDPE prices increased in the European region.

An industry source in Europe informed a Polymerupdate team member, "Stronger import price offers, primarily for linear low density polyethylene (LLDPE), combined with the strong dollar and weak euro, as well as the US and Middle Eastern maintenance season, drove prices higher. Despite the slow demand, sellers held onto their offers because they believed that the March pricing outlook was firm and that there were fewer spot volumes available at the lower end of the price ranges.” The source added, “Following a increase in the monthly contract price (MCP) of feedstock ethylene, polyethylene (PE) prices increased in Europe in February. Taking advantage of increased demand due to seasonal restocking and a higher price floor on US imports, many producers and sellers have pushed for steeper increases in PE prices in an effort to increase their margins. So far, sellers have been more successful in obtaining steeper increases in freely negotiated contract prices of LLDPE butene grades, although the results have been mixed and mostly grade-dependent.”

The source added, “Following a increase in the monthly contract price (MCP) of feedstock ethylene, polyethylene (PE) prices increased in Europe in February. Taking advantage of increased demand due to seasonal restocking and a higher price floor on US imports, many producers and sellers have pushed for steeper increases in PE prices in an effort to increase their margins. So far, sellers have been more successful in obtaining steeper increases in freely negotiated contract prices of LLDPE butene grades, although the results have been mixed and mostly grade-dependent.”

Most market participants are of the opinion that demand fundamentals are unlikely to experience major changes in March with seasonal restocking expected to continue. Overall, the underlying sentiment remains cautious. Additionally, most market participants are more focused on keeping inventory under control than raising buffer stocks. With ongoing stagnation and the threat of a recession, Europe's economic situation remains difficult. Furthermore, a substantial rise in disposable income is still some time off, and consumer confidence continued to be low. Uncertainty surrounding trade tariffs with the US is adding to business planners' worries, as it may negatively affect PE value chains.

LLDPE contract prices have also increased more than ethylene due to decreased supply and a higher import price floor from the US. While some plant outages still exist, producers have raised operating rates wherever feasible to meet the increased demand.

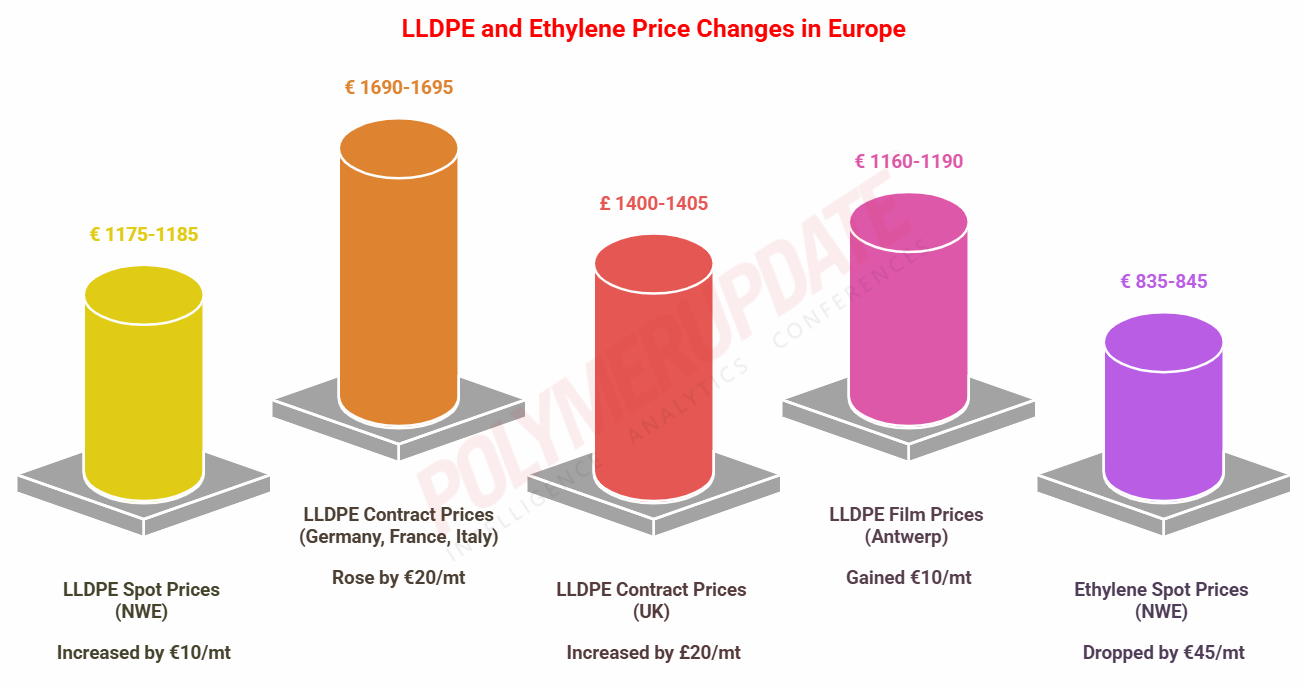

In the spot markets, LLDPE prices were assessed at the Euro 1175-1185/mt FD Northwest Europe levels, a rise of Euro (+10/mt) from the previous week.

In the contract markets, LLDPE grade prices were assessed at the Euro 1690-1695/mt FD NWE Germany and FD NWE France levels, both gaining by Euro (+20/mt) week on week. LLDPE grade prices were assessed at the Euro 1690-1695/mt FD NWE Italy levels, a week on week rise of Euro (+20/mt). Meanwhile, LLDPE grade prices were assessed at the GBP 1400-1405/mt FD NWE UK levels, up GBP (+20/mt) from the previous week.

FCA Antwerp LLDPE film prices were assessed at the Euro 1160-1190/mt levels, a gain of Euro (+10/mt) from last week.

Ethylene spot prices on Thursday were assessed at the Euro 835-845/mt FD North West Europe levels, a tumble of Euro (-45/mt) from the previous week.

European ethylene contract price for February 2025 settled at the Euro 1257.50/MT FD North West Europe levels. This price represents a sharp rise of Euro 52.50/MT from its January 2025 settlement levels.