This week, HDPE prices drifted lower in the European region.

An industry source in Europe informed a Polymerupdate team member, "European HDPE market fundamentals were marked by weak demand and a decelerated purchase pulse. While industry participants pointed to some stability in prices as compared to a steep drop last year, consumer demand has largely been tepid throughout the year with no hope foreseen for a pickup in demand for the remaining part of the year. Import cargoes have been noted to be plentiful in the region, leading to a supply glut situation. Meanwhile, demand from derivative industries has been weakening persistently, with market participants remaining sceptical about the possibility of end-user demand improving in the coming months.”

The source added, "In spite of some domestic overhauls, HDPE material was available in adequate quantities due to inflows of import cargoes. October is likely to see the influx of competitively-priced import shipments, with prices anticipated to be in the same range as September levels. Spot trading momentum experienced a slowdown, a sign of weak demand sentiment with buyers opting to make need-based purchases and focusing their attention on the months ahead.”

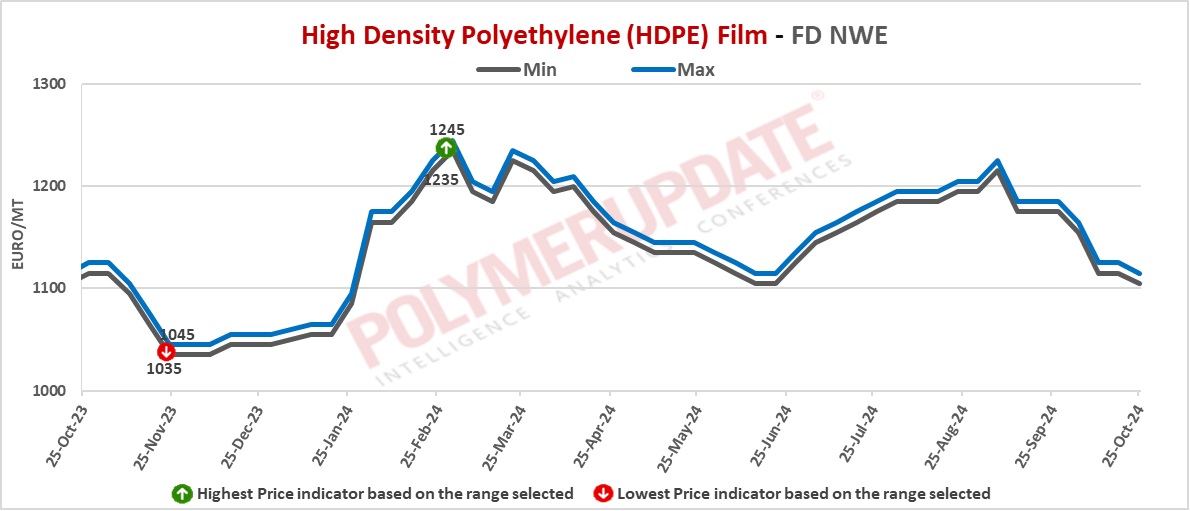

HDPE film grade prices were assessed at the Euro 1105-1115/mt FD North West Europe levels, while HDPE injection grade prices were assessed at the Euro 1065-1075/mt FD North West Europe Levels, both dropping by Euro (-10/mt) from the previous week. Meanwhile, HDPE BM grade prices were assessed at the Euro 1095-1105/mt FD North West Europe levels, a week on week decrease of Euro (-20/mt).

In the contract markets, HDPE film grade prices were assessed at the Euro 1530-1535/mt FD NWE Germany and FD NWE Italy levels, both falling by Euro (-20/mt) from last week. HDPE film grade prices were assessed at the Euro 1530-1535/mt FD NWE France levels, a week on week drop of Euro (-20/mt). Meanwhile, HDPE film grade prices were assessed at the GBP 1275-1280/mt FD NWE UK levels, down GBP (-20/mt) from the previous week.

In the contract markets, HDPE BM grade prices were assessed at the Euro 1510-1515/mt FD NWE Germany and FD NWE Italy levels, both falling by Euro (-20/mt) week on week. HDPE BM grade prices were assessed at the Euro 1510-1515/mt FD NWE France levels, down Euro (-20/mt) from last week. Meanwhile, HDPE BM grade prices were assessed at the GBP 1255-1260/mt FD NWE UK levels, a week on week decline of GBP (-25/mt).

In the contract markets, HDPE injection grade prices were assessed at the Euro 1470-1475/mt FD NWE Germany and FD NWE Italy levels, both lower by Euro (-20/mt) from the previous week. HDPE injection grade prices were assessed at the Euro 1470-1475/mt FD NWE France levels, a week on week decrease of Euro (-20/mt). Meanwhile, HDPE injection grade prices were assessed at the GBP 1225-1230/mt FD NWE UK levels, down GBP (-20/mt) from last week.

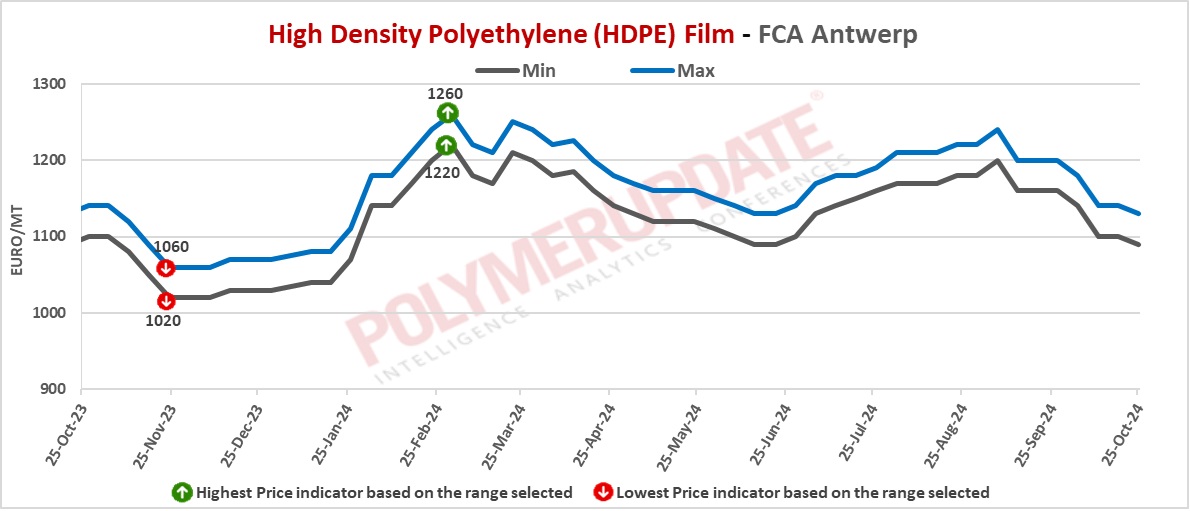

FCA Antwerp HDPE film prices were assessed at the Euro 1090-1130/mt levels, while FCA Antwerp HDPE injection prices were assessed at the Euro 1050-1080/mt levels, both decreasing by Euro (-10/mt) from the previous week. Meanwhile, FCA Antwerp HDPE injection prices were assessed at the Euro 1080-1110/mt levels, a week on week fall of Euro (-20/mt).

Ethylene spot prices on Thursday were assessed at the Euro 820-830/mt FD North West Europe levels, a decline of Euro (-20/mt) from last week.

European ethylene feedstock contract price for October 2024 settled at the Euro 1182.50/MT FD North West Europe levels. This price represents a sharp drop of Euro (-32.50/mt) from its September 2024 settlement levels.