This week, LLDPE spot prices plummeted in the European region.

An industry source in Europe informed a Polymerupdate team member, "The European LLDPE market experienced sluggish trading activity owing to dampened purchase appetite seen in the post-summer holiday period. Demand for LDPE grades remained tepid over the past week, with most buyers having concluded their purchases prior to September as they expected a rise in prices. Meanwhile, spot prices remained in the stable to moderately weaker range, mirroring a slowdown in buyer enquiries."

The source added, "The impact of soft demand fundamentals was offset by domestic supply constraints, especially for specific LLDPE grades."

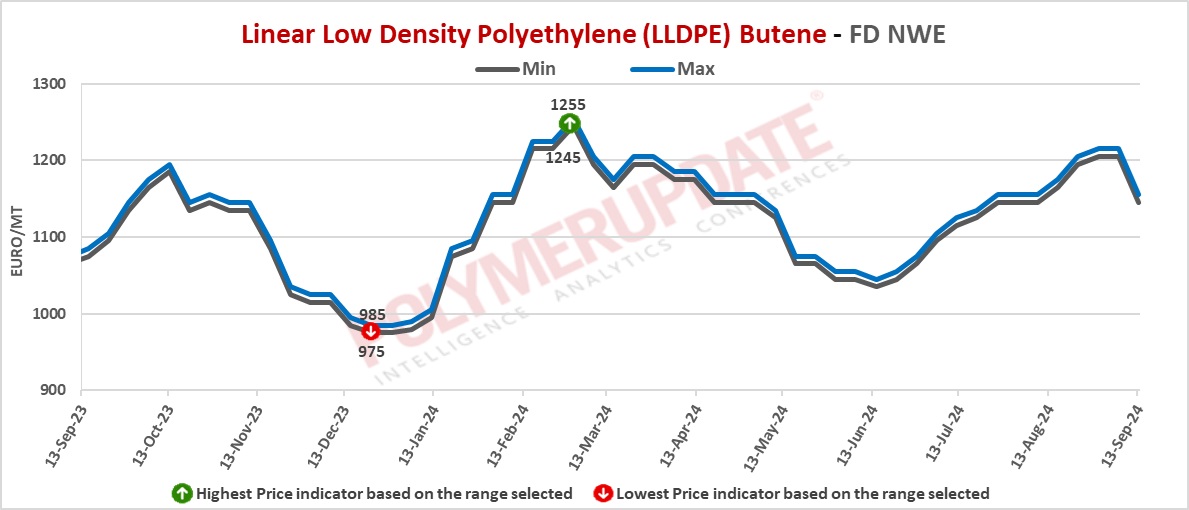

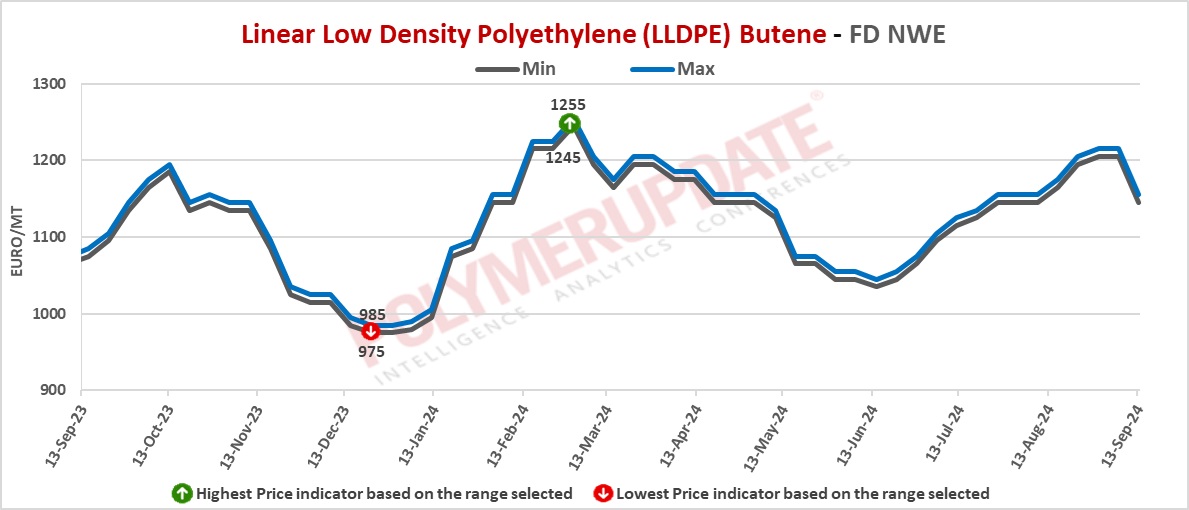

In the spot markets, LLDPE prices were assessed at the Euro 1145-1155/mt FD Northwest Europe levels, a tumble of Euro (-60/mt) from the previous week.

In the contract markets, LLDPE grade prices were assessed at the Euro 1620-1625/mt FD NWE Germany and FD NWE France levels, both left unchanged from last week. LLDPE grade prices were assessed at the Euro 1620-1625/mt FD NWE Italy levels, stable from the previous week. Meanwhile, LLDPE grade prices were assessed at the GBP 1365-1370/mt FD NWE UK levels, flat from the previous week.

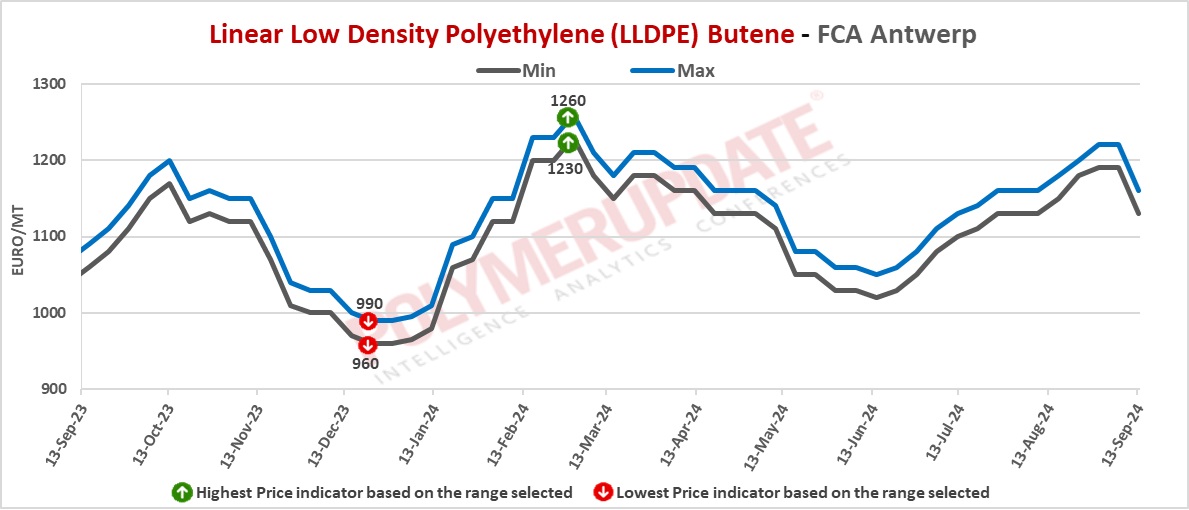

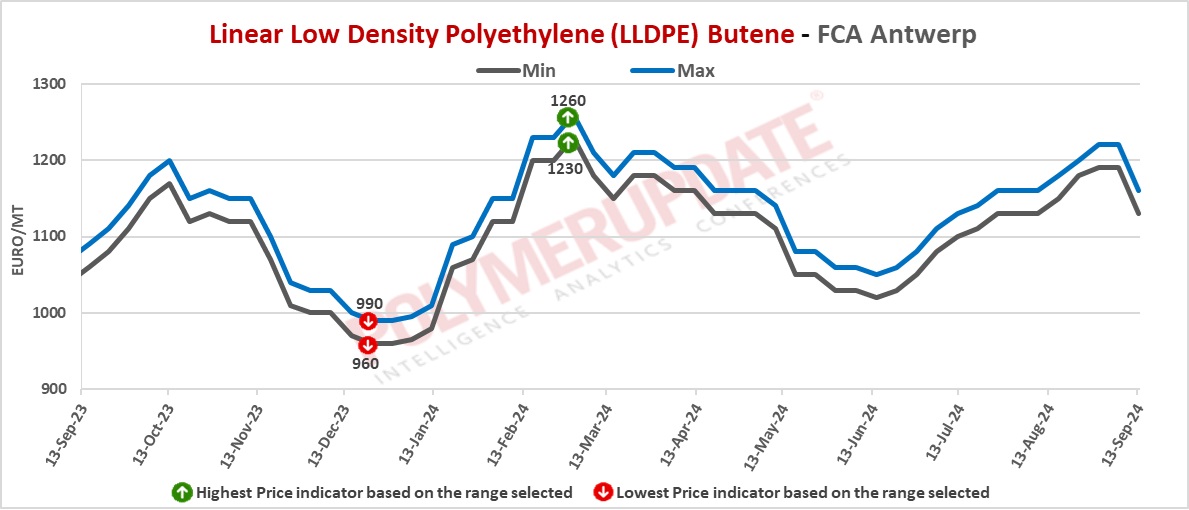

FCA Antwerp LLDPE film prices were assessed at the Euro 1130-1160/mt levels, sharply lower by Euro (-60/mt) from last week.

Ethylene spot prices on Thursday were assessed at the Euro 925-935/mt FD North West Europe levels, a marginal rise of Euro (+5/mt) from the previous week.

European ethylene feedstock contract price for September 2024 settled at the Euro 1215/MT FD North West Europe levels. This price represents a decline of Euro (-25/mt) from its August 2024 settlement levels.