This week, HDPE grade prices decreased in Europe.

A European industry source while requesting to remain unidentified informed a Polymerupdate team member, “The European HDPE market experienced a subdued trading momentum, as reflected in the weakening purchase appetite for materials. The adverse impact on market sentiment, arising from a combination of bearish factors comprising weak demand and sufficient supplies, has been pressuring prices lower. Consumers were seen preferring to make need-based purchases owing to a fall in orders from end user industries. The decline in the June contract price for feedstock ethylene further lent support to the downward pricing trend.”

Another source familiar with current market developments informed, ”Market participants are not hopeful of an improvement in the current market situation. There has been a continual rise in PE imports, with most sellers hastening to offload their stocks upon arrival, leading to a steady drop in prices.”

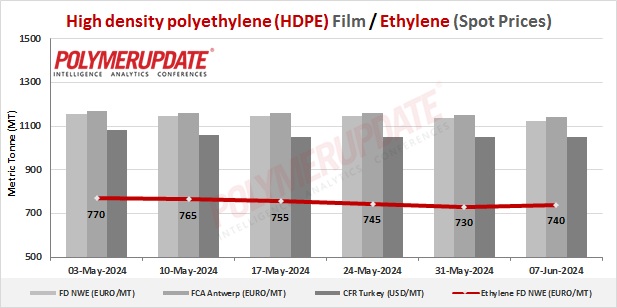

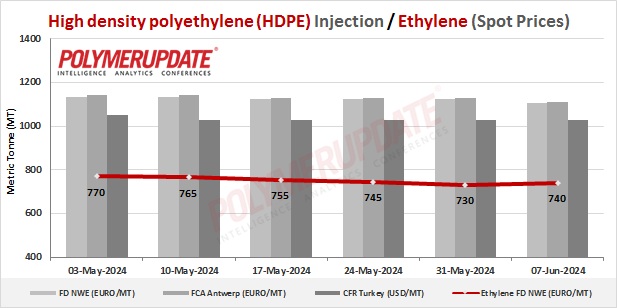

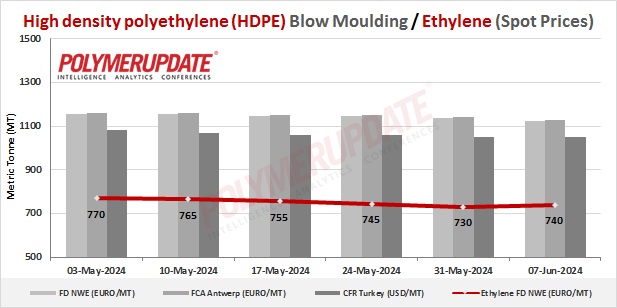

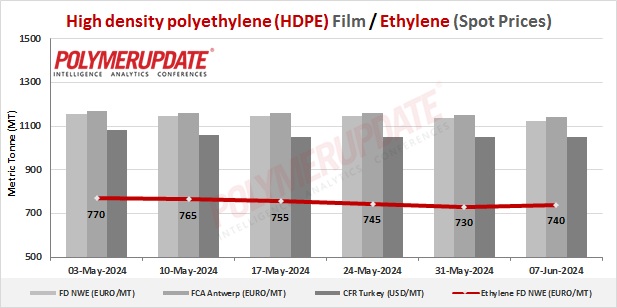

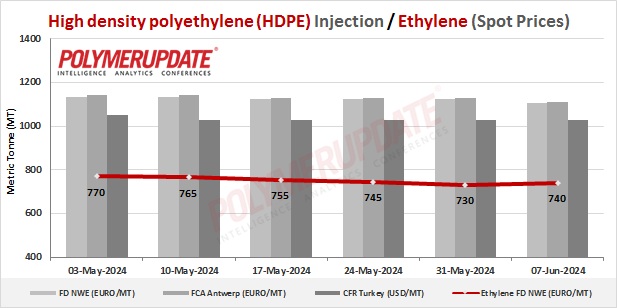

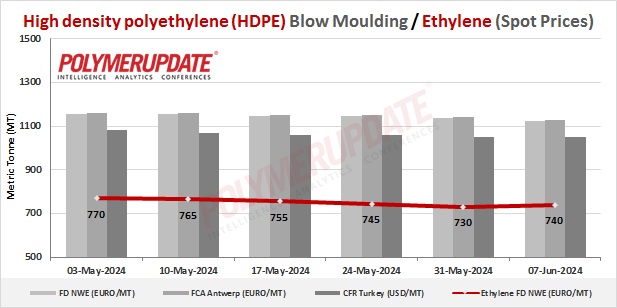

In the spot markets, HDPE BM grade prices were assessed at the Euro 1115-1125/mt FD North West Europe levels while HDPE film grade prices were assessed at the Euro 1115-1125/mt FD North West Europe levels, both falling by Euro (-10/mt) week on week. Meanwhile, HDPE injection grade prices were assessed at the Euro 1095-1105/mt FD North West Europe levels, a week on week drop of Euro (-20/mt).

In the contract markets, HDPE film grade prices were assessed at the Euro 1565-1570/mt FD NWE Germany and FD NWE Italy levels, both down Euro (-15/mt) from last week. HDPE film grade prices were assessed at the Euro 1565-1570/mt FD NWE France levels, a week on week fall of Euro (-15/mt). Meanwhile, HDPE film grade prices were assessed at the GBP 1330-1335/mt FD NWE UK levels, down GBP (-15/mt) from the previous week.

In the contract markets, HDPE BM grade prices were assessed at the Euro 1545-1550/mt FD NWE Germany and FD NWE Italy levels, both declining by Euro (-15/mt) week on week. HDPE BM grade prices were assessed at the Euro 1545-1550/mt FD NWE France levels, a drop of Euro (-15/mt) from last week. Meanwhile, HDPE BM grade prices were assessed at the GBP 1315-1320/mt FD NWE UK levels, a fall of GBP (-10/mt) from the previous week.

In the contract markets, HDPE injection grade prices were assessed at the Euro 1495-1500/mt FD NWE Germany and FD NWE Italy levels, both lower by Euro (-15/mt) from the previous week. HDPE injection grade prices were assessed at the Euro 1495-1500/mt FD NWE France levels, a week on week decrease of Euro (-15/mt). Meanwhile, HDPE injection grade prices were assessed at the GBP 1270-1275/mt FD NWE UK levels, a drop of GBP (-10/mt) from last week.

FCA Antwerp HDPE film prices were assessed at the Euro 1100-1140/mt levels, a fall of Euro (-10/mt) week on week, while FCA Antwerp HDPE BM prices were assessed at the Euro 1100-1130/mt levels, a drop of Euro (-10/mt). Meanwhile, FCA Antwerp HDPE injection prices were assessed at the Euro 1080-1110/mt levels, a decrease of Euro (-20/mt) from the previous week.

Ethylene spot prices on Thursday were assessed at the Euro 730-740/mt FD North West Europe levels, up Euro (+10/mt) from last week.

European ethylene feedstock contract price for June 2024 settled at the Euro 1220/MT FD North West Europe levels. This price represents a drop of Euro 30/mt from its May 2024 settlement levels.