This week, PVC prices witnessed a rise in South Asia, while they quoted flat in China and the Southeast Asian region.

An industry source in Asia wishing to remain unidentified informed a Polymerupdate team member, "Pricing trends continue to remain bullish on the back of higher energy prices. Meanwhile, global ocean freight rates have almost doubled with market participants experiencing acute challenges in securing container space allocations. Rising prospects of disruptions to cargo movements stemming from the ongoing Red Sea crisis combined with imbalances in demand and supply of shipping containers could exert a severely adverse impact on global maritime trade in the near to medium term.”

The source added, “Formosa orders for June shipment have been postponed to July-August owing to prevailing higher freight rates resulting from short supply of shipping containers. Furthermore, other overseas suppliers have also raised their offers across other South Asian markets.”

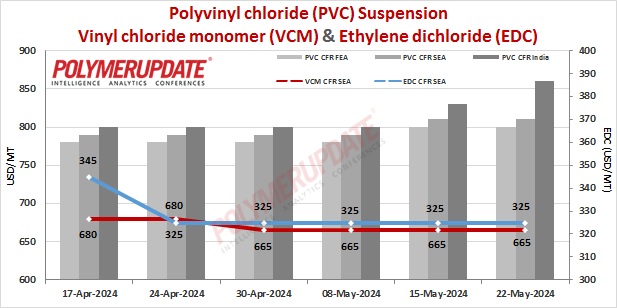

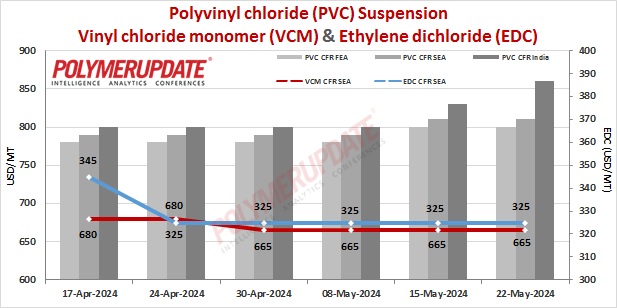

In India, PVC prices were assessed at the USD 830-860/mt CFR levels, a week on week rise of USD (+20/+30/mt).

In India, an overseas supplier has offered its PVC resin Suspension grades in the range of USD 830-860/mt levels for shipment in June/July 2024.

A domestic industry source informed a Polymerupdate team member, “Reliance Industries Limited raised PVC grade prices by Rs.3/kg basic with effect from May 22, 2024. Following the price hike, the West zone new basic price is Rs.84.38/kg. Meanwhile, the current trading price of PVC in the local market is Rs.96-97/kg. Buyers are estimating that the ensuing price gap of Rs.12-13/kg could prompt domestic producers to increase prices further to narrow the price difference.”

In Pakistan, PVC prices were assessed at the USD 830-880/mt CFR levels, a gain of USD (+10/mt) week on week.

In Pakistan, an overseas supplier has offered its PVC resin Suspension grades in the range of USD 830-880/mt levels for shipment in June/July 2024.

In Sri Lanka, PVC prices were assessed at the USD 840-860/mt CFR levels, an increase of USD (+30/mt) from last week.

In Sri Lanka, an overseas supplier has offered its PVC resin Suspension grades in the range of USD 840-860/mt levels for shipment in June/July 2024.

In Bangladesh, PVC prices were assessed at the USD 840-860/mt CFR levels, a week on week steep gain of USD (+40/mt).

In Bangladesh, an overseas supplier has offered its PVC resin Suspension grades in the range of USD 840-860/mt levels for shipment in June/July 2024.

Meanwhile in China, PVC prices were assessed at the USD 790-800/mt CFR levels, unchanged from last week.

In Southeast Asia, PVC prices were assessed steady at the USD 790-810/mt CFR levels.

In spite of higher PVC futures on the Dalian Commodity Exchange (DCE) in China and elevated freight rates, prices remained steady in China and Southeast Asia.

Feedstock EDC prices were assessed at the USD 295-305/mt CFR China levels while CFR South East Asia EDC prices were assessed at the USD 315-325/mt levels, both constant week on week.

CFR South East Asia VCM prices were assessed at the USD 655-665/mt levels while CFR China VCM prices were assessed at the USD 580-590/mt levels, both flat from the previous week.

Feedstock ethylene CFR North East Asia prices were assessed stable at the USD 850-860/mt levels. CFR South East Asia ethylene prices were assessed at the USD 950-960/mt levels, a drop of USD (-25/mt) from the previous week.

In plant news, Erdos is likely to shut down its Polyvinyl chloride (PVC) plant for maintenance on June 28, 2024. The plant is slated to remain offline for about 15 days. Located in Inner Mongolia, China, the PVC plant has production capacity of 400,000 mt/year.

Shanghai Chlor-alkali Chemical has taken off stream its Polyvinyl chloride (PVC) unit for maintenance on May 16, 2024. The plant is slated to remain offline for about 30 days. Located in Shaanxi, China, the PVC unit has production capacity of 90,000 mt/year.

Yangmei Hengtong has shut down its Polyvinyl chloride (PVC) unit for maintenance on May 17, 2024. The unit is slated to remain offline for about one month. Located in Shandong province, China, the unit has production capacity of 300,000 mt/year.