This week, LLDPE spot prices plunged in the European region.

A European industry source while requesting to remain unidentified informed a Polymerupdate team member, “The European LLDPE market continued to experience a bearish pricing pressure owing to excess material avails. The surfacing of competitive offers and increased availability of import cargoes from the US, Egypt, and the Middle East further weighed on prices. Weak consumer demand and an influx of import cargoes has exacerbated an already gloomy market situation. Consumers are refraining from buying in bulk quantities and are making need-based purchases.”

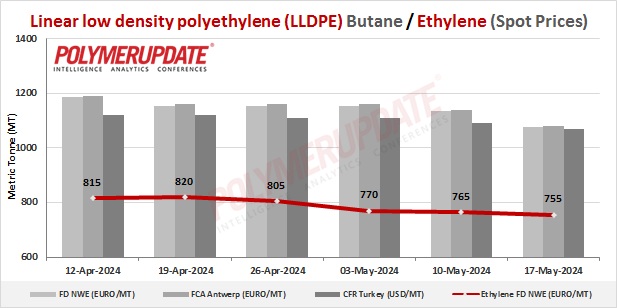

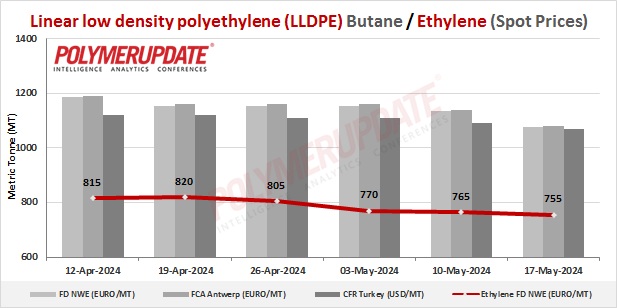

In the spot markets, LLDPE prices were assessed at the Euro 1065-1075/mt FD Northwest Europe levels, a week on week tumble of Euro (-60/mt).

In the contract markets, LLDPE grade prices were assessed at the Euro 1660-1665/mt FD NWE Germany and FD NWE France levels, both unchanged from last week. LLDPE grade prices were assessed at the Euro 1660-1665/mt FD NWE Italy levels, rolled over week on week. Meanwhile, LLDPE grade prices were assessed at the GBP 1415-1420/mt FD NWE UK levels, a marginal fall of GBP (-5/mt) from the previous week.

FCA Antwerp LLDPE film prices were assessed at the Euro 1050-1080/mt levels, a week on week plunge of Euro (-60/mt).

Ethylene spot prices on Thursday were assessed at the Euro 745-755/mt FD North West Europe levels, a fall of Euro (-10/mt) from last week.

European ethylene feedstock contract price for May 2024 settled at the Euro 1250/MT FD North West Europe levels. This price represents a drop of Euro 10/mt from its April 2024 settlement levels.