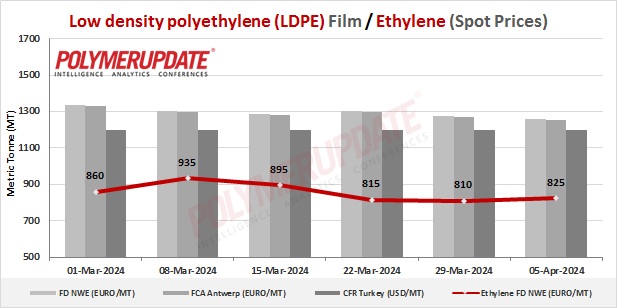

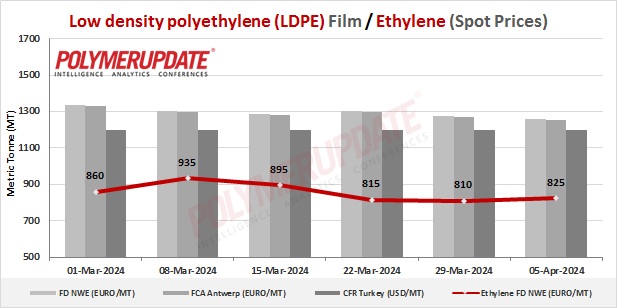

LDPE spot prices declined in the European region this week.

In the spot markets, LDPE prices were assessed at the Euro 1250-1260/mt FD Northwest Europe mark, a week on week decrease of Euro (-15/mt). An industry source in Europe informed a Polymerupdate team member, “Market activity across the European low density polyethylene (LDPE) market had quietened with the weak purchase extending into April. The tepid market sentiment for LDPE was exacerbated with participants winding down operations early for Easter and displaying a lack of enthusiasm to resume trading after the holiday.”

The source added, ”The regional market has been largely muted during and after the holiday. Reduction in offtake of material by end-users mirrored dampened demand fundamentals. There was hardly any pickup in spot market momentum through the week even as limited market activity and a lack of firmer spot offers in March exerted a bearish pressure on prices."

In the contract markets, General Purpose LDPE grade prices were assessed at the Euro 1870-1875/mt FD NWE Germany and FD NWE Italy levels, both quoting flat from week on week. LDPE General Purpose grade prices were assessed at the Euro 1870-1875/mt FD NWE France levels, steady from last week. Meanwhile, LDPE grade prices were assessed at the GBP 1600-1605/mt FD NWE UK levels, stable from the previous week.

FCA Antwerp LDPE General Purpose film prices were assessed at the Euro 1235-1255/mt levels, week on week lower by Euro (-15/mt).

Ethylene spot prices on Thursday were assessed at the Euro 815-825/mt FD North West Europe levels, a week on week gain of Euro (+15/mt).

European ethylene feedstock contract price for April 2024 settled at the Euro 1260/MT FD North West Europe levels. This price represents a sharp rise of Euro 40/mt from its March 2024 settlement levels.