This week, HDPE prices journeyed northward in Europe.

A European industry source while requesting to remain unidentified informed a Polymerupdate team member, “Regional HDPE avails were limited on the back of continuing outages. Supply constraints have prompted domestic producers to raise prices following the settlement of monomer prices early this month. Nevertheless, reports surfaced in the previous week of a few suppliers downscaling their prices in line with a dampened purchase pulse.”

The source added, “Currently, the market sentiment is seemingly subdued with the approaching of April owing to an anticipated rise in material supplies and weak demand fundamentals.”

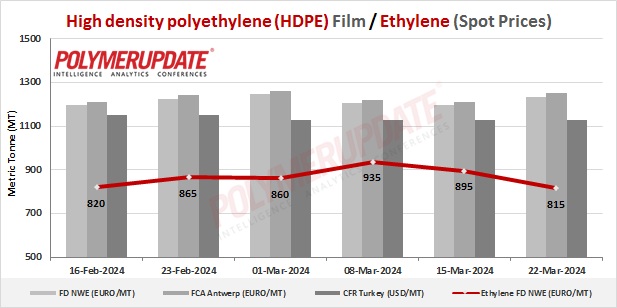

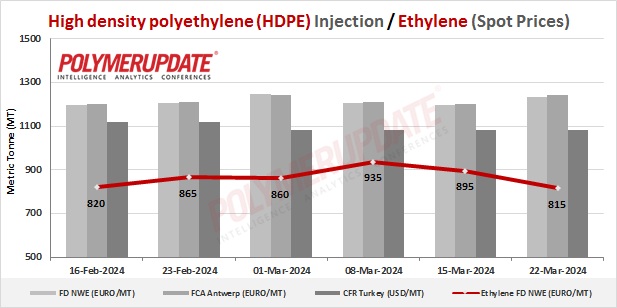

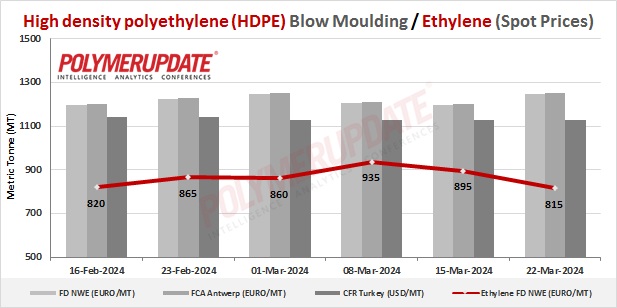

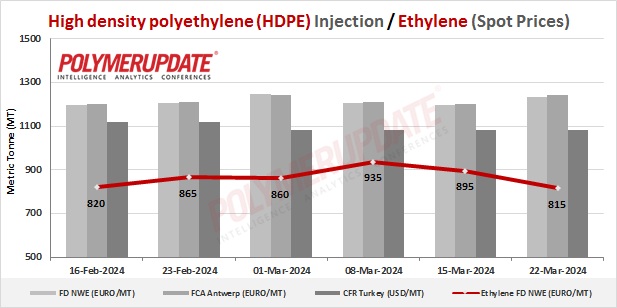

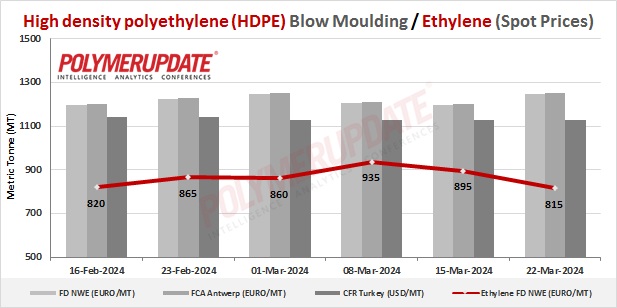

In the spot markets, HDPE film grade prices were assessed at the Euro 1225-1235/mt FD North West Europe levels, a sharp rise of Euro (+40/mt) from the previous week. while HDPE BM grade prices were assessed at the Euro 1235-1245/mt FD North West Europe levels, a spike of Euro (+50/mt) from last week. HDPE injection moulding grade prices were assessed at the Euro 1225-1235/mt FD North West Europe levels, higher by Euro (+40/mt) week on week.

In the contract markets, HDPE film grade prices were assessed at the Euro 1600-1605/mt FD NWE Germany and FD NWE Italy levels, both rising by Euro (+40/mt) week on week. HDPE film grade prices were assessed at the Euro 1600-1605/mt FD NWE France levels, a sharp gain of Euro (+40/mt) from the previous week. Meanwhile, HDPE film grade prices were assessed at the GBP 1365-1370/mt FD NWE UK levels, up GBP (+30/mt) from last week.

In the contract markets, HDPE BM grade prices were assessed at the Euro 1580-1585/mt FD NWE Germany and FD NWE Italy levels, both gaining by Euro (+40/mt) from last week. HDPE BM grade prices were assessed at the Euro 1580-1585/mt FD NWE France levels, sharply increasing by Euro (+40/mt) from the previous week. Meanwhile, HDPE BM grade prices were assessed at the GBP 1345-1350/mt FD NWE UK levels, week on week higher by GBP (+30/mt).

In the contract markets, HDPE injection grade prices were assessed at the Euro 1530-1535/mt FD NWE Germany and FD NWE Italy levels, both quoting week on week higher by Euro (+40/mt). HDPE injection grade prices were assessed at the Euro 1530-1535/mt FD NWE France levels, an increase of Euro (+40/mt) from last week. Meanwhile, HDPE injection grade prices were assessed at the GBP 1305-1310/mt FD NWE UK levels, week on week higher by GBP (+30/mt).

FCA Antwerp HDPE film prices were assessed at the Euro 1210-1250/mt levels, a sharp rise of Euro (+40/mt) from last week. FCA Antwerp HDPE BM prices were assessed at the Euro 1220-1250/mt levels, a spike of Euro (+50/mt) from last week. FCA Antwerp HDPE injection prices were assessed at the Euro 1210-1240/mt levels, higher by Euro (+40/mt) from last week.

Ethylene spot prices on Thursday were assessed at the Euro 805-815/mt FD North West Europe levels, a steep week on week decline by Euro (-80/mt).

European ethylene feedstock contract price for March 2024 settled at the Euro 1220/MT FD North West Europe levels. This price represents an increase of Euro 30/mt from its February 2024 settlement levels.