This week, HDPE prices displayed a mixed undertone in Europe.

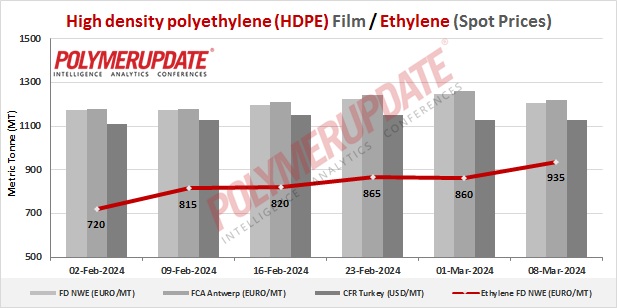

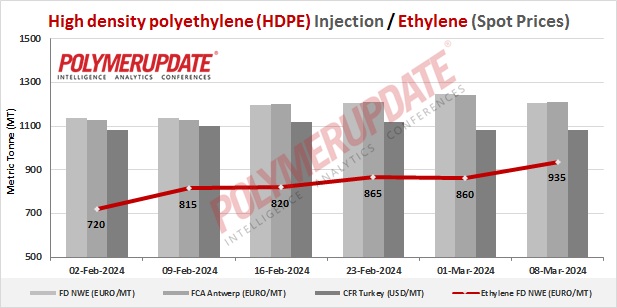

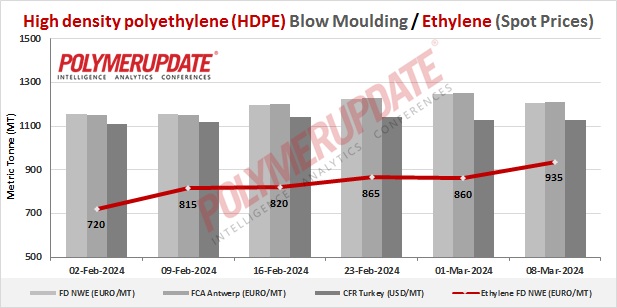

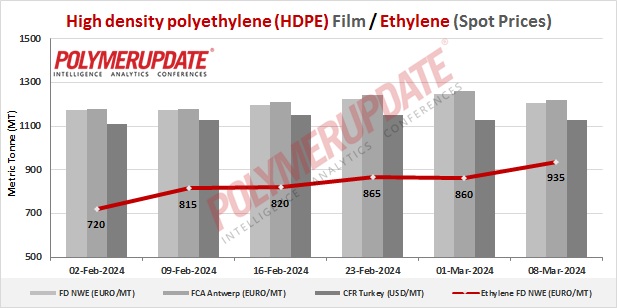

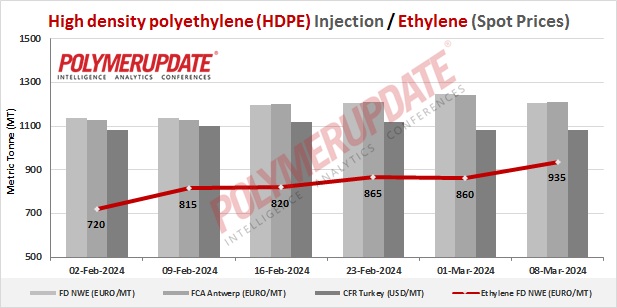

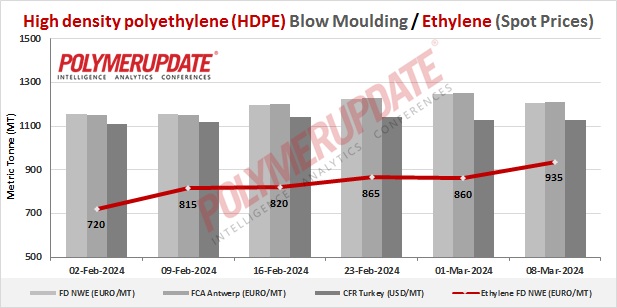

In the spot markets, HDPE film grade prices were assessed at the Euro 1195-1205/mt FD North West Europe levels, while HDPE BM grade prices were assessed at the Euro 1195-1205/mt FD North West Europe levels, both sharply lower by Euro (-40/mt) from the previous week. HDPE injection moulding grade prices were assessed at the Euro 1195-1205/mt FD North West Europe levels, a sharp decline of Euro (-40/mt) week on week. A European industry source while requesting to remain unidentified informed a Polymerupdate team member, “Spot market prices experienced a downtrend on the back of a surge in overseas competitive offers and weakening purchase interest, even though there was an increase in the March ethylene contract price.”

In the contract markets, HDPE film grade prices were assessed at the Euro 1560-1565/mt FD NWE Germany and FD NWE Italy levels, both week on week rising by Euro (+20/mt). HDPE film grade prices were assessed at the Euro 1560-1565/mt FD NWE France levels, a gain of Euro (+20/mt) from the previous week. Meanwhile, HDPE film grade prices were assessed at the GBP 1335-1340/mt FD NWE UK levels, week on week higher by GBP (+20/mt).

In the contract markets, HDPE BM grade prices were assessed at the Euro 1540-1545/mt FD NWE Germany and FD NWE Italy levels, both gaining by Euro (+20/mt) from last week. HDPE BM grade prices were assessed at the Euro 1540-1545/mt FD NWE France levels, a rise by Euro (+20/mt) from the previous week. Meanwhile, HDPE BM grade prices were assessed at the GBP 1315-1320/mt FD NWE UK levels, week on week up GBP (+15/mt).

In the contract markets, HDPE injection grade prices were assessed at the Euro 1490-1495/mt FD NWE Germany and FD NWE Italy levels, both higher by Euro (+20/mt) week on week. HDPE injection grade prices were assessed at the Euro 1490-1495/mt FD NWE France levels, an increase of Euro (+20/mt) from last week. Meanwhile, HDPE injection grade prices were assessed at the GBP 1275-1280/mt FD NWE UK levels, week on week up GBP (+20/mt).

A European industry source while requesting to remain unidentified informed a Polymerupdate team member, “Contract prices rose in line with higher crude oil rates and an increase in the European ethylene contract price for March 2024. Meanwhile, market participants also pointed to continuing supply constraints and delays in arrivals of import material from the Middle East as key factors responsible for pushing prices higher. However, buyers were reportedly unwilling to accept the higher price levels, reflecting a decline in buying interest.”

FCA Antwerp HDPE film prices were assessed at the Euro 1180-1220/mt levels, a sharp fall of Euro (-40/mt) from last week. FCA Antwerp HDPE BM prices were assessed at the Euro 1180-1210/mt levels, a sharp decrease by Euro (-40/mt) from last week. FCA Antwerp HDPE injection prices were assessed at the Euro 1180-1210/mt levels, lower by Euro (-30/mt) from last week.

Ethylene spot prices on Thursday were assessed at the Euro 925-935/mt FD North West Europe levels, a steep gain of Euro (+75/mt) week on week.

European ethylene feedstock contract price for March 2024 settled at the Euro 1220/MT FD North West Europe levels. This price represents an increase of Euro 30/mt from its February 2024 settlement levels.