LDPE prices rose steeply in the European region.

An industry source in Europe informed a Polymerupdate team member, “European market conditions have been marked by supply constraints for prompt deliveries, leading to prices trending higher. Supply tightness for LDPE grades has persisted amid lower output levels while extended delays in import cargo arrivals in the region are likely to stretch into March. However, higher offers are not garnering much interest with converters who are displaying a reluctance to transact at elevated price levels.”

The source added, “Meanwhile, trading activity had decelerated across the European LDPE market towards the end of February, with domestic producers focusing on March and closing their order books.”

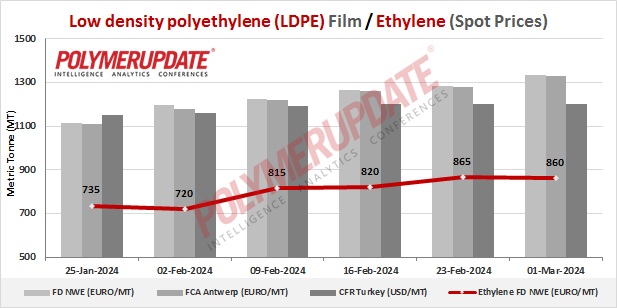

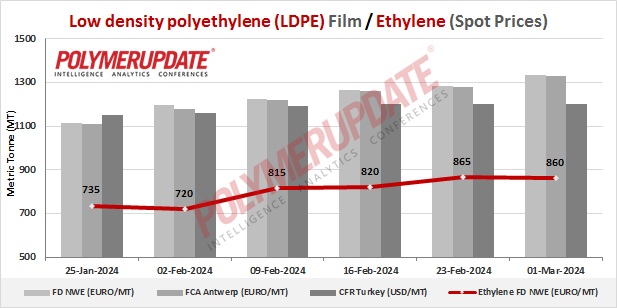

In the spot markets, LDPE prices were assessed at the Euro 1325-1335/mt FD Northwest Europe mark, a week on week spike of Euro (+50/mt).

In the contract markets, General Purpose LDPE grade prices were assessed at the Euro 1780-1785/mt FD NWE Germany and FD NWE Italy levels, both steeply rising by Euro (+50/mt) from the previous week. LDPE General Purpose grade prices were assessed at the Euro 1780-1785/mt FD NWE France levels, a week on week spike of Euro (+80/mt). Meanwhile, LDPE grade prices were assessed at the GBP 1520-1525/mt FD NWE UK levels, sharply gaining by GBP (+40/mt) from last week.

FCA Antwerp LDPE General Purpose film prices were assessed at the Euro 1310-1330/mt levels, a sharp week on week gain of Euro (+50/mt).

Ethylene spot prices on Thursday were assessed at the Euro 850-860/mt FD North West Europe levels, a marginal drop of Euro (-5/mt) week to week.

European ethylene feedstock contract price for February 2024 settled at the Euro 1190/MT FD North West Europe levels. This price represents a rise of Euro 5/mt from its January 2024 settlement levels.