This week, HDPE prices journeyed northward in the European region.

A European industry source while requesting to remain unidentified informed a Polymerupdate team member, “Prices gained on the back of prevailing tight supplies prompted by delayed cargo arrivals from the Middle East and limited material quantities arriving from the US. The price rise was further supported by curtailed output rates and a few outages in the region.”

The source added, ”The overall demand situation could be described as mostly static, with market players having to deal with tepid end-user industry demand. Meanwhile, market players are currently focused on March, with discussions centred mainly on possible ethylene contract price settlements for the month ahead.”

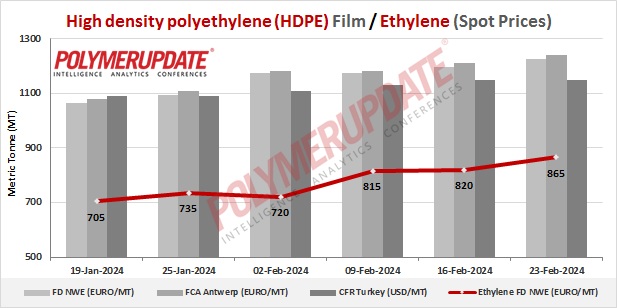

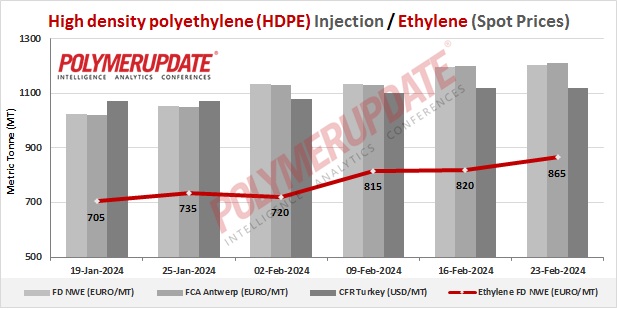

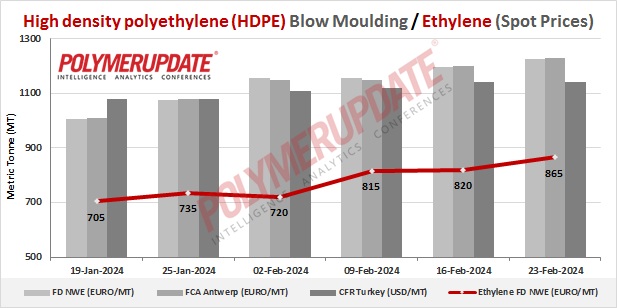

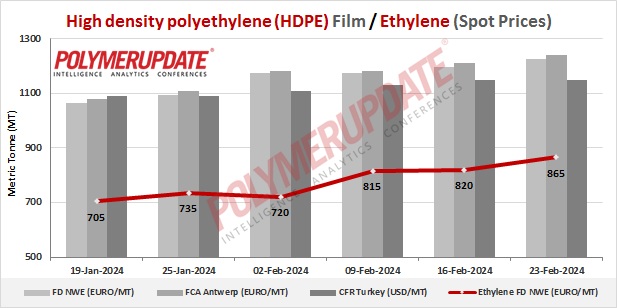

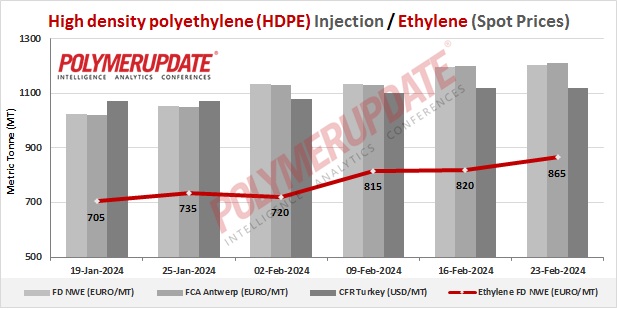

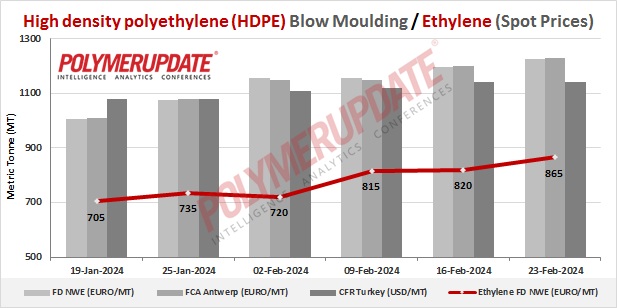

In the spot markets, HDPE film grade prices were assessed at the Euro 1215-1225/mt FD North West Europe levels, an increase of Euro (+30/mt) from the previous week. HDPE BM grade prices were assessed at the Euro 1215-1225/mt FD North West Europe levels, a week on week rise by Euro (+30/mt). HDPE injection moulding grade prices were assessed at the Euro 1195-1205/mt FD North West Europe levels, a gain of Euro (+10/mt) from last week.

In the contract markets, HDPE film grade prices were assessed at the Euro 1520-1525/mt FD NWE Germany and FD NWE Italy levels, both week on week sharply up by Euro (+45/mt). HDPE film grade prices were assessed at the Euro 1520-1525/mt FD NWE France levels, a sharp rise of Euro (+45/mt) from the previous week. Meanwhile, HDPE film grade prices were assessed at the GBP 1300-1305/mt FD NWE UK levels, a week on week spike of GBP (+40/mt).

In the contract markets, HDPE BM grade prices were assessed at the Euro 1500-1505/mt FD NWE Germany and FD NWE Italy levels, both gaining steeply by Euro (+45/mt) from last week. HDPE BM grade prices were assessed at the Euro 1500-1505/mt FD NWE France levels, a sharp rise by Euro (+45/mt) from the previous week. Meanwhile, HDPE BM grade prices were assessed at the GBP 1285-1290/mt FD NWE UK levels, a week on week spike of GBP (+40/mt).

In the contract markets, HDPE injection grade prices were assessed at the Euro 1450-1455/mt FD NWE Germany and FD NWE Italy levels, both sharply higher by Euro (+45/mt) week on week. HDPE injection grade prices were assessed at the Euro 1450-1455/mt FD NWE France levels, a sharp increase of Euro (+45/mt) from last week. Meanwhile, HDPE injection grade prices were assessed at the GBP 1240-1245/mt FD NWE UK levels, a week on week spike of GBP (+40/mt).

FCA Antwerp HDPE film prices were assessed at the Euro 1200-1240/mt levels, higher by Euro (+30/mt) from the previous week. FCA Antwerp HDPE BM prices were assessed at the Euro 1200-1230/mt levels, an increase of Euro (+30/mt) from last week. FCA Antwerp HDPE injection prices were assessed at the Euro 1180-1210/mt levels, a rise of Euro (+10/mt) from last week.

Ethylene spot prices on Thursday were assessed at the Euro 855-865/mt FD North West Europe levels, a steep rise of Euro (+45/mt) week on week.

European ethylene feedstock contract price for February 2024 settled at the Euro 1190/MT FD North West Europe levels. This price represents a rise of Euro 5/mt from its January 2024 settlement levels.