This week, PP spot prices trended lower in Europe.

An industry source in Europe informed a Polymerupdate team member, “Amidst a winter downturn and weak demand for derivatives, market players in the European polypropylene markets have begun winding down their operations. The main trend in the market appears to be a decline in demand as buyers have already acquired the necessary stocks for the final phases of the year."

The source said,” The majority of purchasers continued to demonstrate no need for surplus material beyond the minimal contractual intake, resulting in particularly weak spot demand. To counter this, vendors operated at lower rates and closely monitored stock levels, somewhat offsetting the consequences of this sluggish demand. In anticipation of the periodic winter destocking process, market players expect reduced volatility in the fourth quarter of 2023. Additionally, imports have further pressured the market, as Middle Eastern and South Korean vendors offered European purchasers materials at attractive prices for delivery in the January and February 2024 shipments.

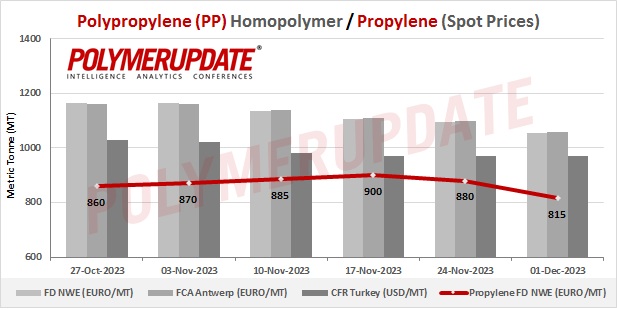

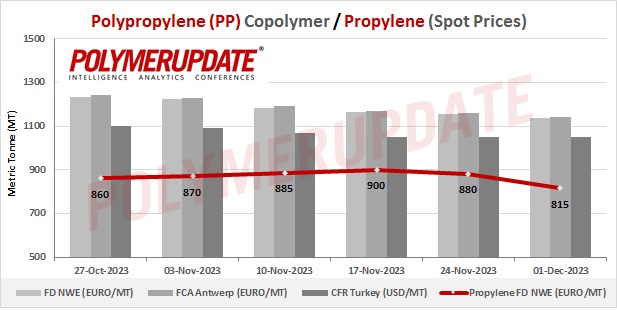

In the spot markets, PP injection moulding grade prices were assessed at the Euro 1045-1055/mt FD North West Europe mark, a sharp drop of Euro (-40/mt). PP block copolymer grade prices were assessed at the Euro 1125-1135/mt FD Northwest Europe levels, a week on week decrease of Euro (-20/mt).

In the contract markets, PP injection moulding grade prices were assessed at the Euro 1385-1390/mt FD NWE Germany and FD NWE France levels, both unchanged from last week. PP injection moulding grade prices were assessed at the Euro 1375- 1380/mt FD NWE Italy levels, steady from the previous week. Meanwhile, PP injection moulding grade prices were assessed at the GBP 1195-1200/mt FD NWE UK levels, a week on week down by GBP (-10/mt).

In the contract markets, PP block copolymer grade prices were assessed at the Euro 1465-1470/mt FD NWE Germany and FD NWE France levels, both left unchanged from last week. PP block copolymer grade prices were assessed at the Euro 1455-1460/mt FD NWE Italy levels, stable from the previous week. Meanwhile, PP block copolymer grade prices were assessed at the GBP 1275-1280/mt FD NWE UK levels, rolled over from last week.

FCA Antwerp PP homopolymer prices were assessed at the Euro 1030-1060/mt levels, a week on week decline of Euro (-40/mt), while FCA Antwerp PP copolymer prices were assessed at the Euro 1110-1140/mt levels, lower by Euro (-20/mt) from the previous week.

Upstream propylene spot prices on Thursday were assessed at the Euro 805-815/mt FD Northwest Europe levels, a steep week on week down by Euro (-65/mt).

Propylene feedstock contract price for December 2023 settled at the Euro 1050/MT FD North West Europe levels. This price represents a drop of Euro 30/mt from its November 2023 settlement levels.